Notable Hit 1: (KMX:NYSE) On Thursday September 28, 2023 CarMax, Inc. (KMX) posted revenues of $7.07 bn slightly above the mean analyst estimate and in the same direction as Advan's forecasted sales. The revenue decreased 13% YoY inline with Advan's foot traffic data decrease of 12% YoY in its car dealerships location in Q2 2024 fiscal. As a result, the stock closed down 13.4% from previous close. Advan's footfall data has a correlation of 0.96 on a YoY basis with KMX's top-line revenue over the last 14 quarters.

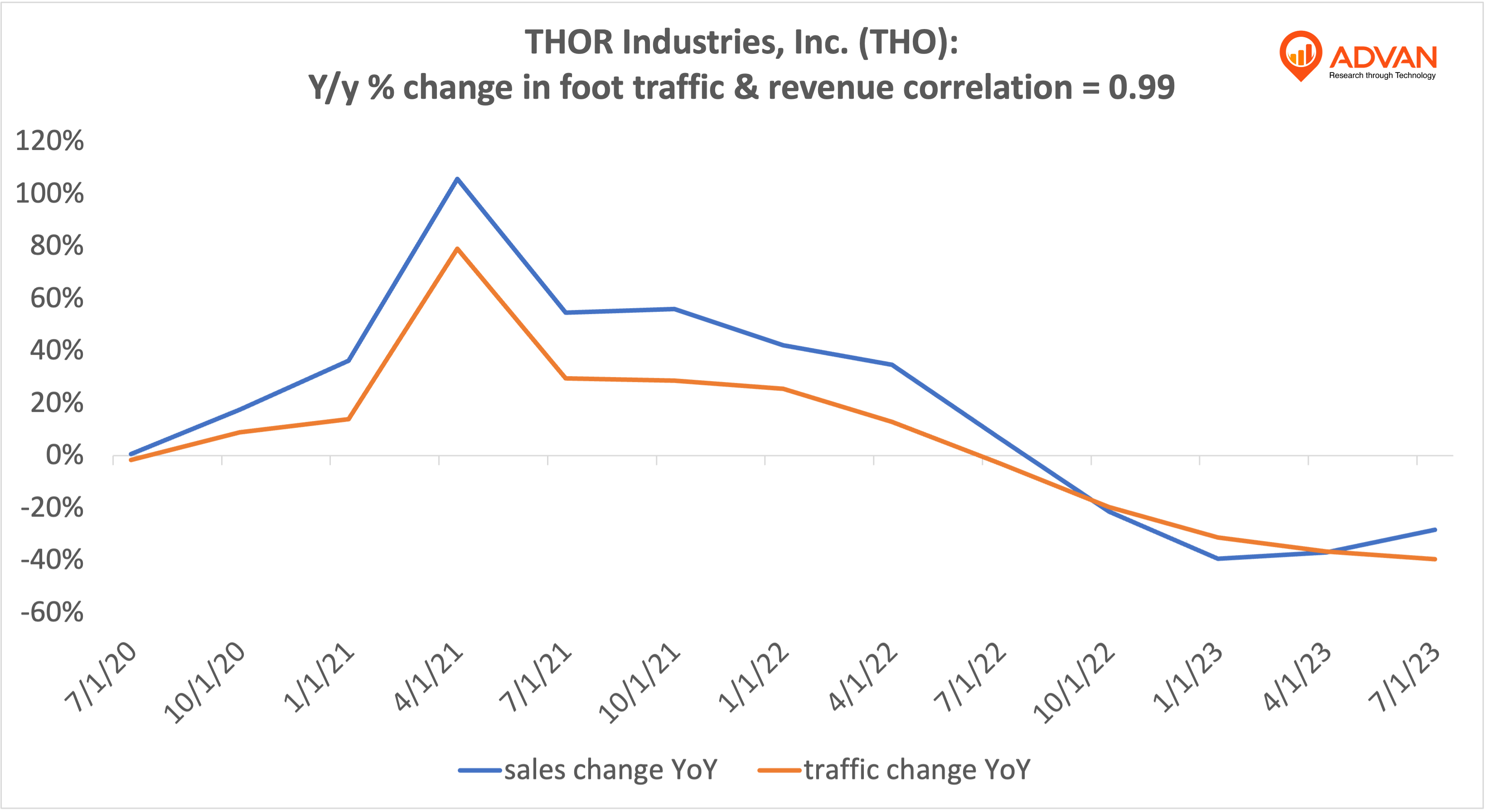

Notable Hit 2: (THO:NYSE) On Monday September 25, 2023 THOR Industries, Inc. (THO) posted revenues of $2.74 bn surpassing the mean analyst estimate of $2.45 bn and in the same direction as Advan's forecasted sales. The revenue decreased 28.4% YoY inline with Advan's foot traffic data decrease of 39.7% YoY in its manufacturing facilities in Q4 2023 fiscal. Advan's footfall data has a correlation of 0.99 on a YoY basis with THO's top-line revenue over the last 13 quarters.

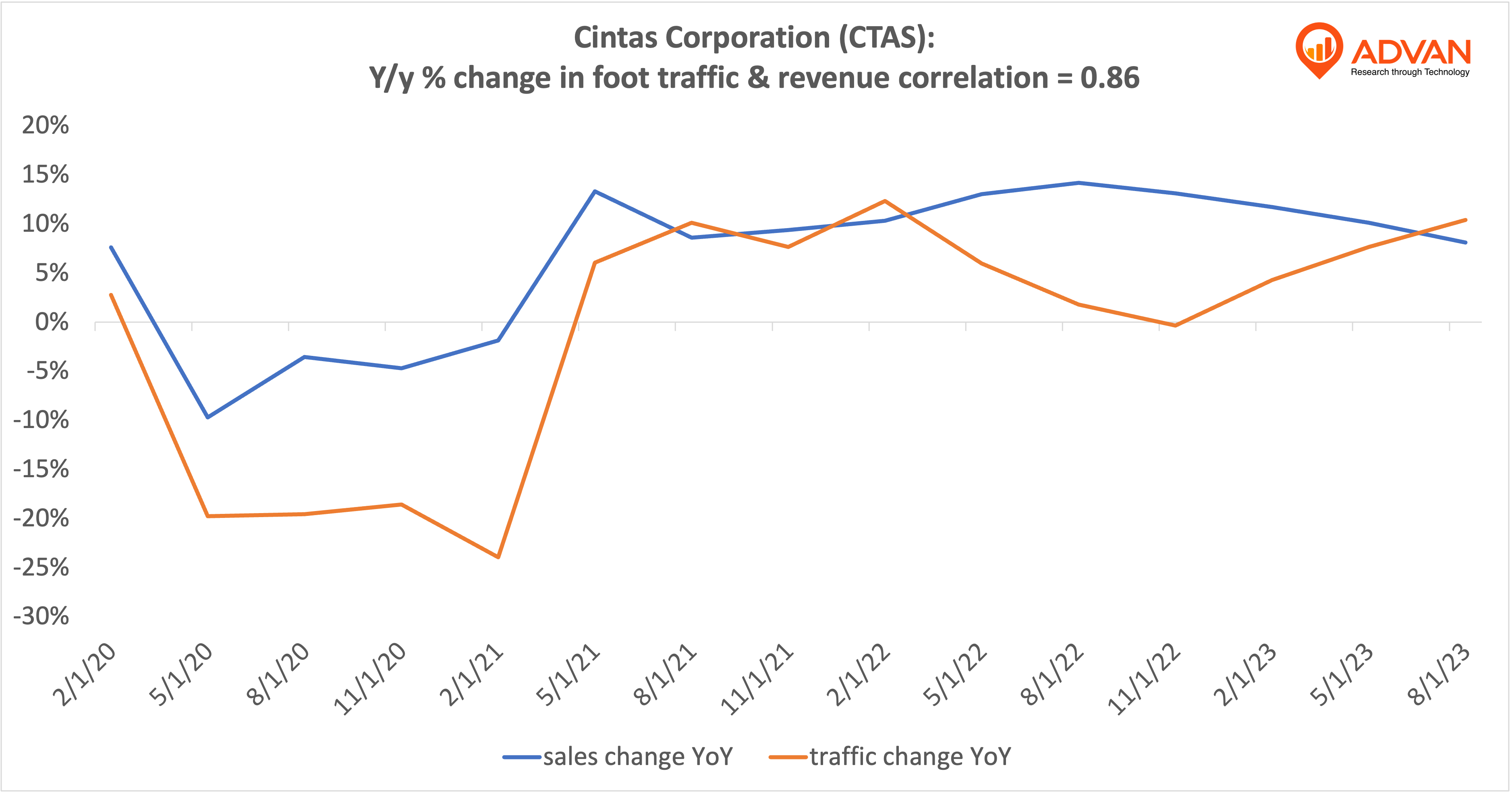

Notable Hit 3: (CTAS:NASDAQ) On Tuesday September 26, 2023 Cintas Corporation (CTAS) posted revenues of $2.34 bn surpassing the mean analyst estimate of $2.33 bn and in the same direction as Advan's forecasted sales. The revenue increased 8.1% YoY inline with Advan's foot traffic data increase of 10.4% YoY in its stores in Q1 2024 fiscal. Advan's footfall data has a correlation of 0.86 on a YoY basis with CTAS's top-line revenue over the last 14 quarters.