By Thomas Paulson, Head of Market Insights

Last Friday, we delivered a presentation to Morgan Stanley’s institutional clients. Our conclusion of the work was that consumer spending had picked up in March following a slow start to the year. However, given Wednesday’s news, what happened in March was of limited importance as the focus ripped over to “how bad are things going to get.” Well to understand how significantly things moved, one needs a starting point. The starting point, from our perspective, was that “things were looking up,” and we had anticipated most retailers to report a stronger than expected and planned for quarter. That would lead to the retailers quickening their pace of orders and feeling more confident in their growth investments in marketing, people, technology, and capacity.

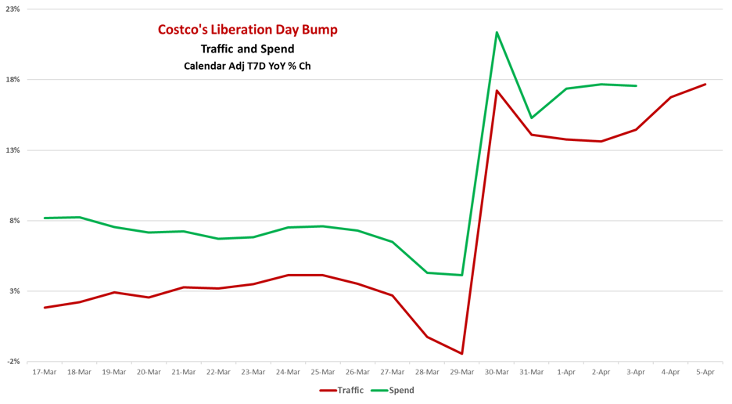

Looking forward, we expect there to be a near-term surge in traffic and demand by more affluent households to purchase discretionary goods ahead of higher prices, as we saw in new car sales in March. US consumers are savvy, and as such, they move fast to secure bargains; Advan sees that readily in Costco’s trends. Traffic and spend spiked the weekend before Liberation Day, as shown in the chart below. We see a similar trend at Sam’s Club, a much bigger lift at RH, and a smaller bump for Target. That makes sense as the higher the affluence of the brand’s customer base, the more that they can afford to buy ahead of price increases. However, this is a pull-forward and as we move into the 2H of April, we’d expect to see notable drops in activity. Obviously, the May and June periods are going to be critical months to observe where things are settling; more on that in May.

Thomas has been Head of Market Insights for Advan Research since January 2025. Previously, he served as Director of Research and Business Development at Placer.ai, where he was instrumental in providing actionable insights derived from location analytics and the path for expansion into new verticals. His extensive background also includes two decades as a Wall Street analyst and portfolio manager in asset management at Alliance Bernstein, Cornerstone, and others. Linkedin profile.