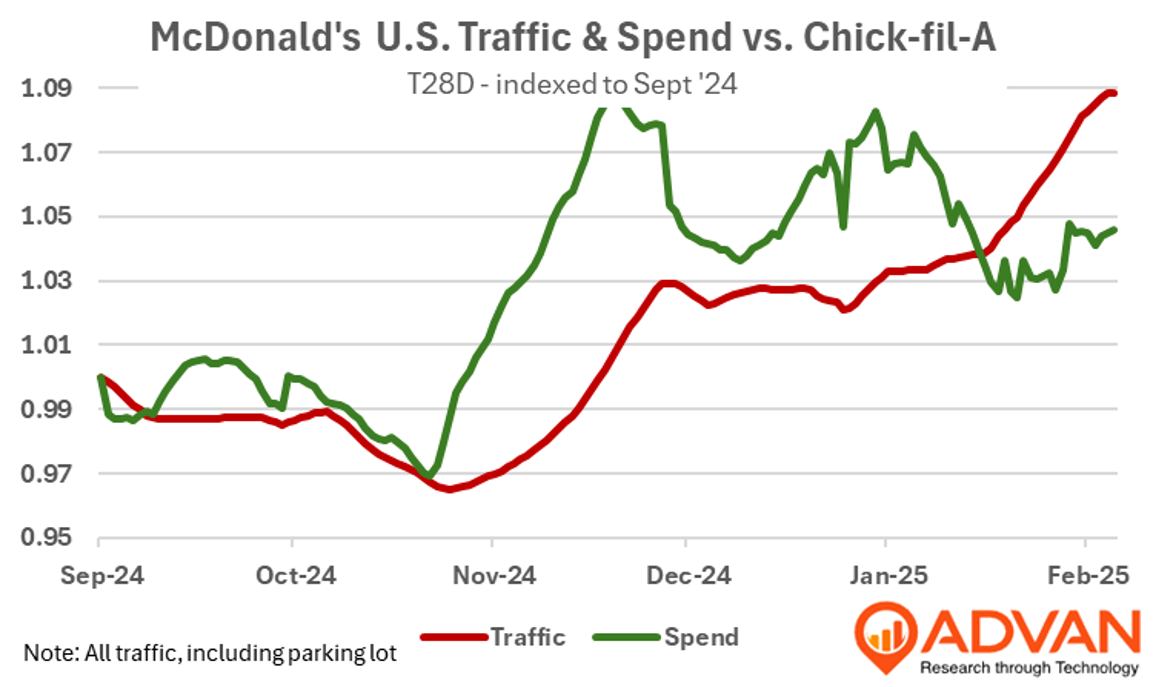

As traffic data and intra-quarter commentary indicated, U.S. comp-sales deteriorated QoQ by -110bps for a -1.4% decline for Q4. Advan Research data showed a -136bps deterioration in traffic and -115bps in spend*. However, since the E. coli scare in October, the traffic and sales trend has improved as shown in the chart above. CEO Kris Kempczinski stated, “The U.S. food safety issue is now largely behind us, and we expect to have fully recovered by the beginning of Q2. At McDonald's, we always say that food safety is our #1 priority, and [the E. coli outbreak was an] unfortunate incident... The strength of our brand depends upon the absolute trust of our customers, and I'm pleased by the positive feedback we've received from so many regarding our rapid and transparent handling of this issue…”

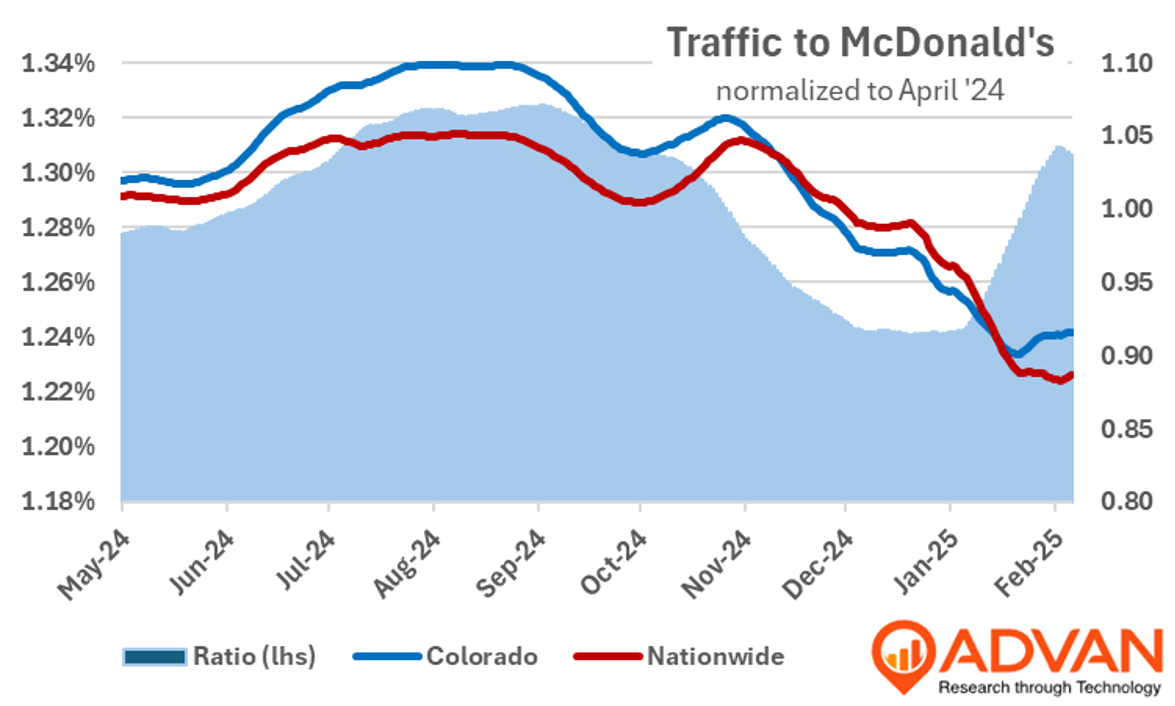

Kampczinski continued, “The E. coli impact is now just localized to the areas that had the biggest impact. So think about that as sort of the Rocky Mountain region. That was really the epicenter of the issue. And that continues to be down versus where we were heading into that impact. But very much seeing it at this point is just contained to that region, whereas the rest of the U.S., we don't see an impact on that. I think, importantly, what it gives us encouragement is we're looking at the trends in those affected areas, and that's what led to our comment around thinking that we'll have it behind us.” As shown in the chart below, the trend in Colorado is roughly back to where it was prior to the incident, confirming management’s commentary.

Aside from the transitory incident, there are two major macro stresses on the business: first, the burger & fry category losing share-of-stomach to other categories like Mediterranean, Mexican, chicken, etc., and second, budget challenges for the less affluent due to the post-pandemic inflationary spike. Improving the perception of McDonal’s value to consumers has been ongoing since last summer and on the latest, Kempczinski said, “Our marketing efforts are reclaiming leadership in value and affordability through initiatives like Every Day Affordable Price menus and meal bundles. In the U.S., the January launch of the McValue platform provides consistent, compelling value with the choice and flexibility our customers want… We look at take rates on the $5 Meal Deal. We look at take rates on the Buy One, Add One for $1. And those take rates are very much in line with what our expectations were for that. So we're pleased with how that's getting out of the gate. From a perception standpoint, as we have increased our focus on value in the U.S., starting last year when we did launch the $5 Meal Deal and then extending into Q1, I've been pleased to see that we're seeing our improvement in getting back to leadership, most recent -- particularly on the most recent visit with value and affordability. So I think we're seeing the customers giving us credit for the value programs that we have put in place there. So feel good about that.” As shown in the first chart above, January inflected to the positive and on a 2-year basis it was down just -1%, a meaningful improvement from the prior months’ double-digit declines. Should positive comp-sales continue for the full quarter, then the 2- and 3-year comp-CAGRs will have improved as well.

To address the share-of-stomach losses, innovation in its chicken offering is a major focus, Kempczinski, “We're excited about the significant opportunity we see within our chicken portfolio and see the potential to add another point of chicken market share by the end of 2026. We continue to roll out McCrispy, which is now in over 70 markets and will be available in nearly all markets by the end of 2025… We'll continue to pulse in the Chicken Big Mac as a limited time only offering over time.” However as shown in the chart below, Chick-fil-A continues to make gains in the QSR segment both in visits and traffic vs. McDonald’s, even past the E. coli incident. As such, there is opportunity for McDonald’s to do better.