Notable Hit 1: (MGM:NASDAQ) On Wednesday November 8, 2023 MGM Resorts International (MGM) posted revenues of $3.97 bn surpassing the mean analyst estimate of $3.91bn and in the same direction as Advan's forecasted sales. The revenue increased 16.3% YoY inline with Advan's foot traffic data increase of 9.8% YoY at its casinos in Q3 2023 fiscal. As a result of beating sales and earnings, the stock next day jumped +3.75%. Advan's footfall data has a correlation of 0.994 on a YoY basis with MGM's top-line revenue over the last 15 quarters.

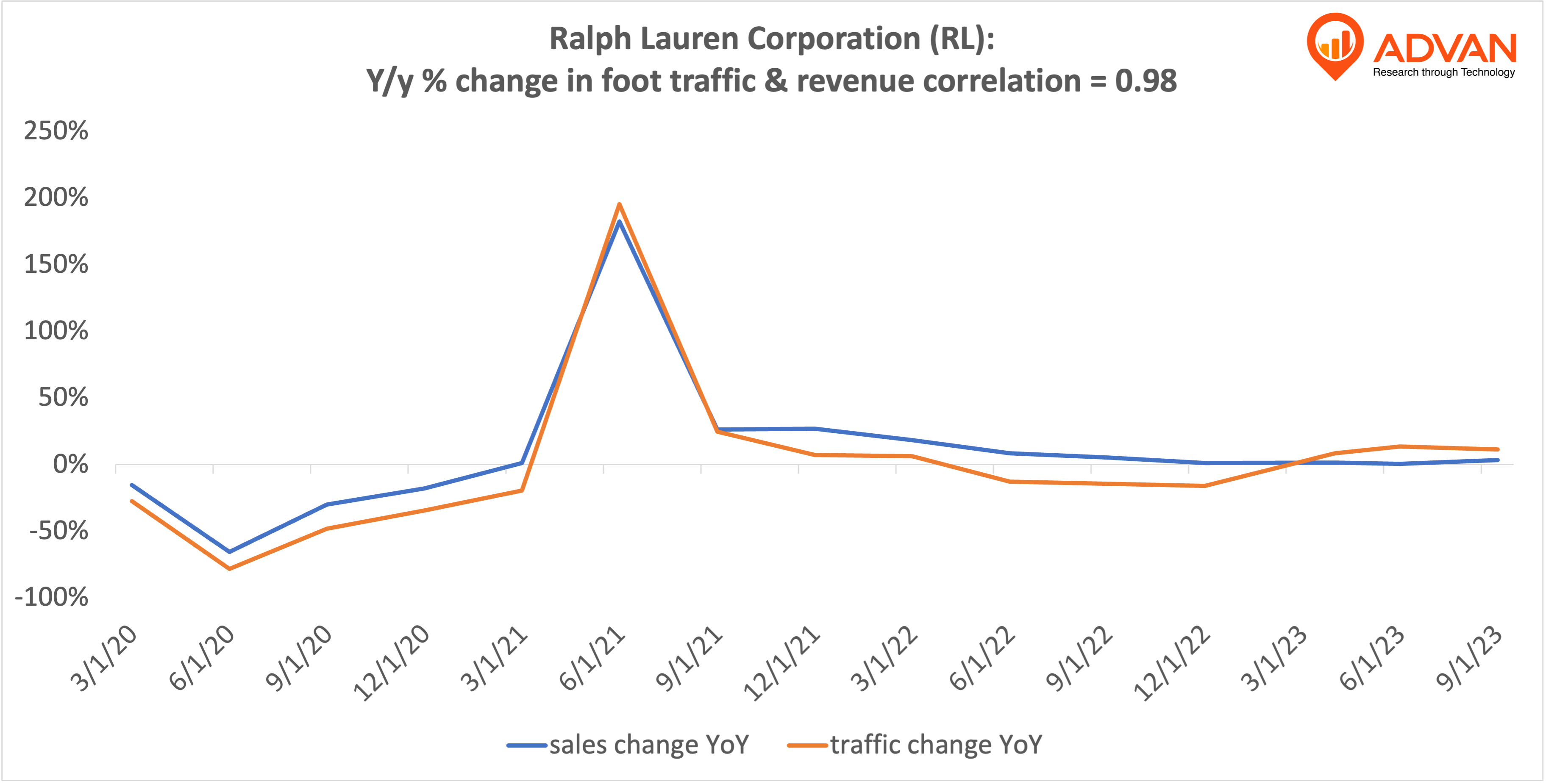

Notable Hit 2: (RL:NYSE) On Wednesday November 8, 2023 Ralph Lauren Corporation (RL) posted revenues of $1.6 bn aligning with the mean analyst estimate of $1.61 bn and in the same direction as Advan's forecasted sales. The revenue increased 3.2% YoY inline with Advan's foot traffic data increase of 11.3% YoY at its stores in Q3 2023 fiscal. As a result of beating the sales and earnings, the stock closed +3.2% from previous close. Advan's footfall data has a correlation of 0.98 on a YoY basis with RL's top-line revenue over the last 15 quarters.

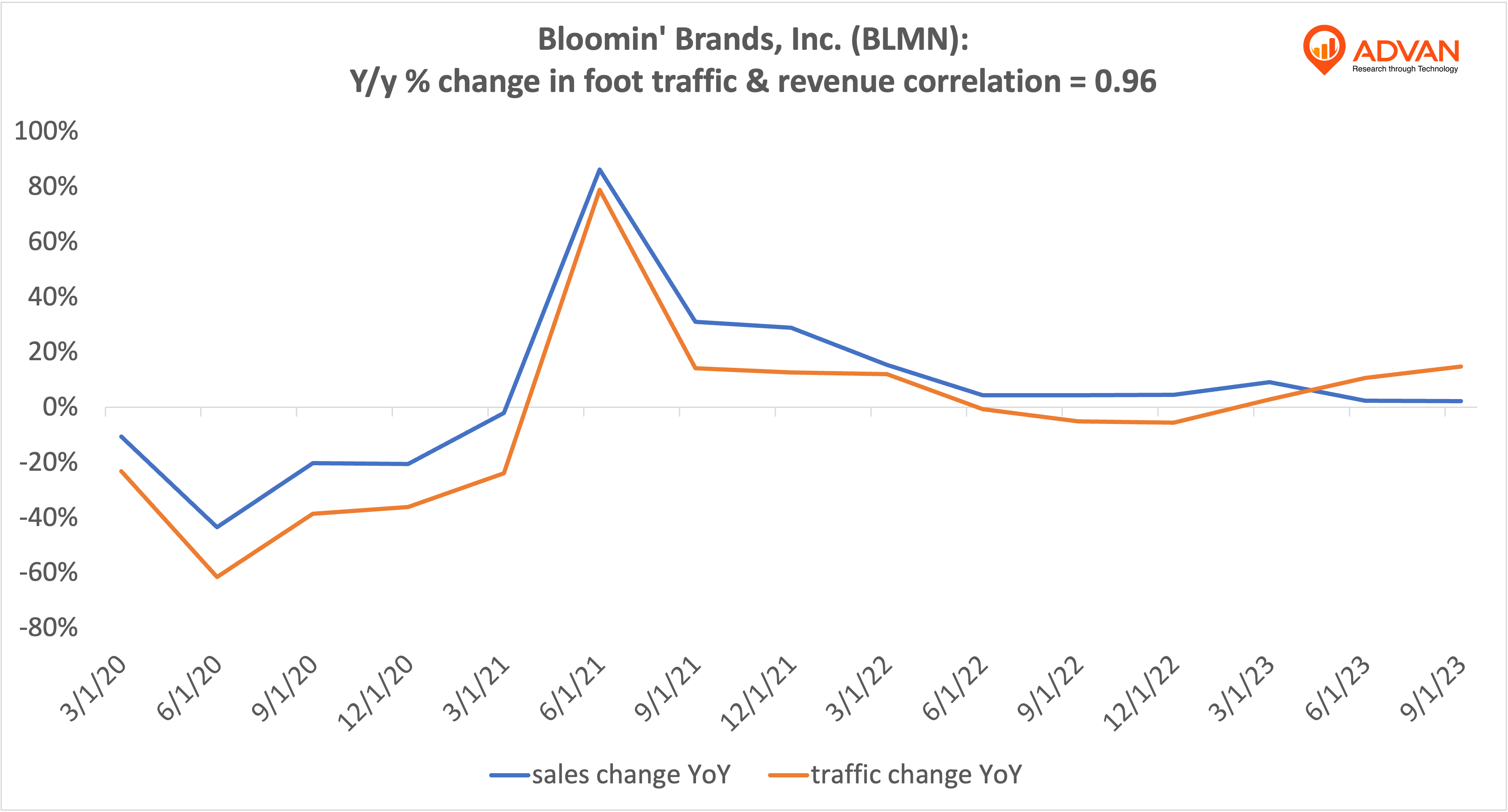

Notable Hit 3: (BLMN:NASDAQ) On Friday November 3, 2023 Bloomin' Brands, Inc. (BLMN) posted revenues of $1.08 bn slightly missing the mean analyst estimate of $1.09 bn and in the same direction as Advan's forecasted sales. The revenue increased 2.3% YoY inline with Advan's foot traffic data increase of 14.8% YoY at its restaurants in Q3 2023. Advan's footfall data has a correlation of 0.96 on a YoY basis with BLMN's top-line revenue over the last 15 quarters.

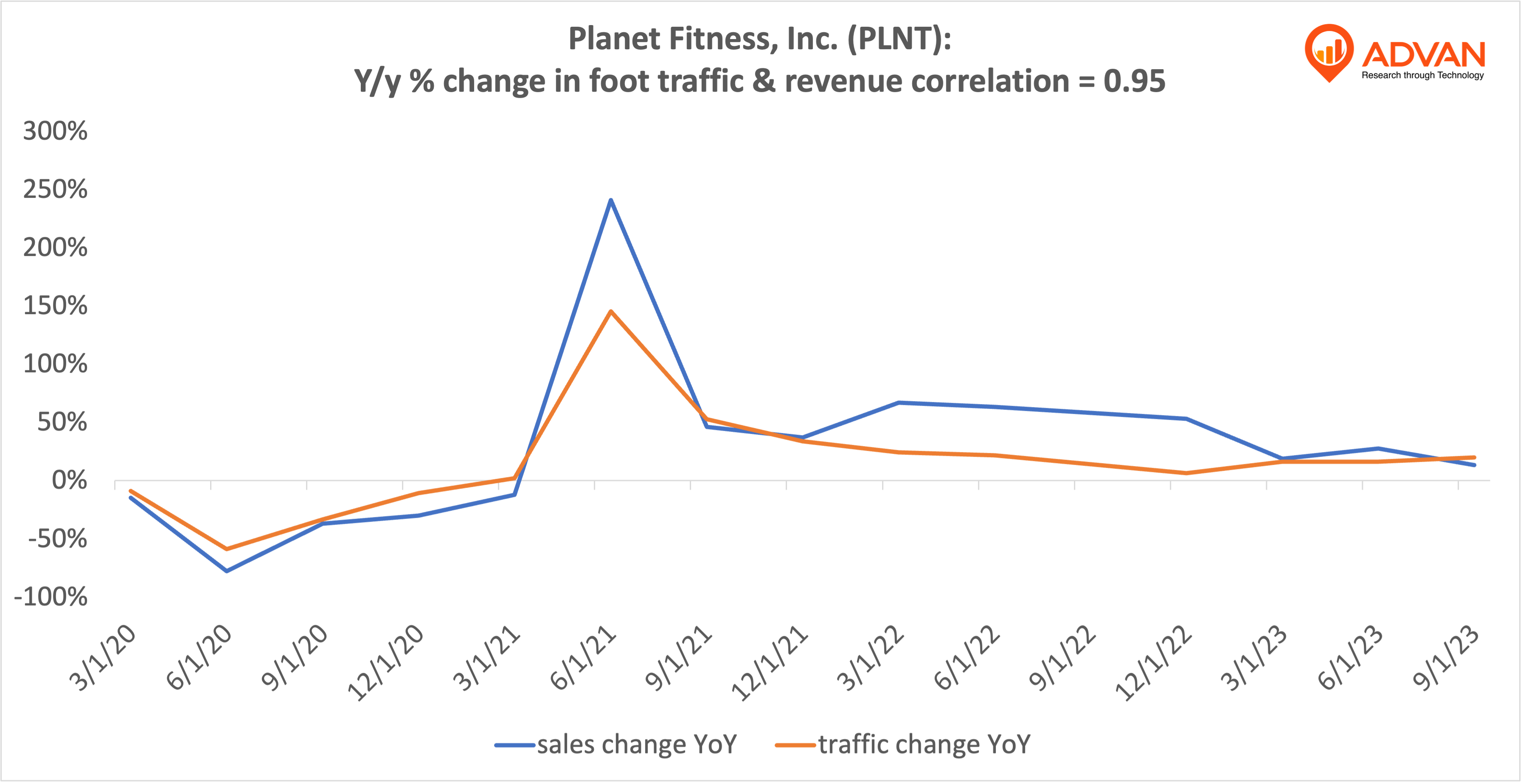

Notable Hit 4: (PLNT:NYSE) On Tuesday November 7, 2023 Planet Fitness, Inc. (PLNT) posted revenues of $277.6 mm surpassing the mean analyst estimate of $267.73 mm and in the same direction as Advan's forecasted sales. The revenue increased 13.6% YoY inline with Advan's foot traffic data increase of 20% YoY at its fitness centers in Q3 2023. As a result of beating sales and earnings, the stock closed +13.7% from previous close. Advan's footfall data has a correlation of 0.95 on a YoY basis with PLNT's top-line revenue over the last 14 quarters.