Markets have reacted very strongly to the potential effects from the coronavirus epidemic in China. MGM, Las Vegas Sands and Wynn Resort stocks have been hit particularly hard, dropping 20% since the news, mostly on fears that their Hong Kong and Macau locations will see materially reduced visitors during the annual Lunar Year celebrations. But are the actual effects on business and travel what the market expects or is this an over-reaction?

To analyze the effects we decided to look at a few key metrics:

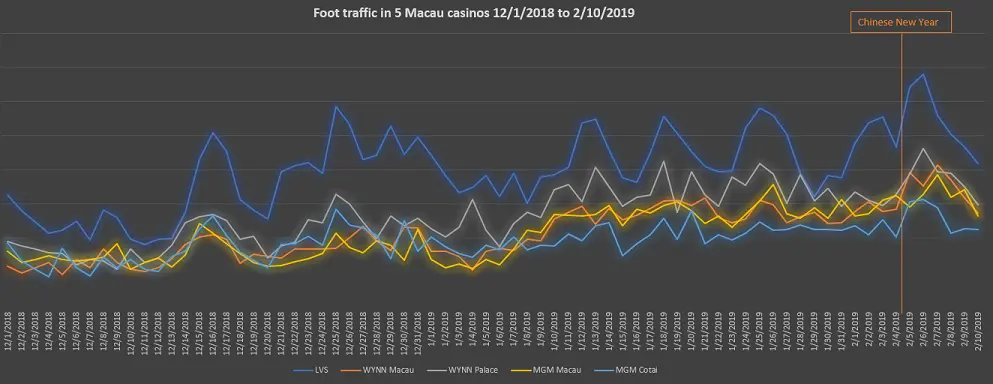

- Macau and Hong Kong casino traffic. We mapped and measured the traffic on the 5 largest MGM, LVS and WYNN properties in Macau

- Macau and Hong Kong airport traffic

- US and Global airport traffic

Let us examine the data in detail.

First, the casinos in Macau and Hong Kong:

Which is materially lower than last year's traffic:

In the first week since the news of the virus, we see that traffic was fairly unchanged, and even increasing in the Las Vegas Sands locations. However, starting in the second week the traffic is starting to fall, and instead of the increase usually seen in the week after the Chinese New Year we see a prolonged slump, with the difference being on the order of -20% instead of the typical +20%, although the large increase after the New Year's is limited to about 1 week.

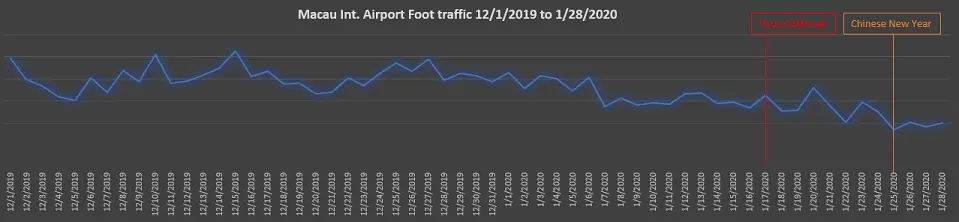

Second, the Macau airport:

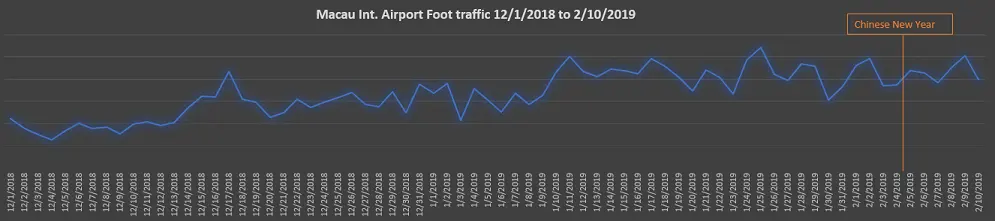

Versus last year:

A similar story unfolds in the Macau airport, although the moves are more muted; the increase after the Chinese New Year was small last year and the drop this year is on the order of 10%.

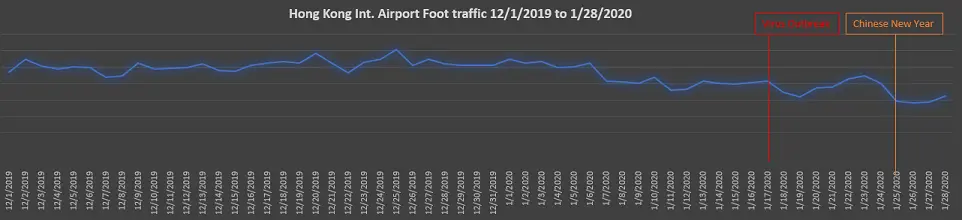

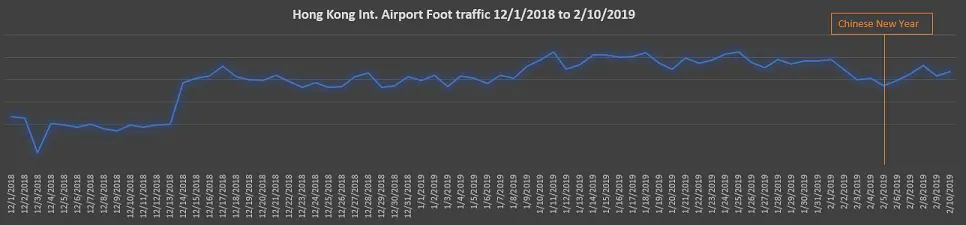

Then we look at the Hong Kong airport:

Versus last year:

This supports the same results as the Macau airport, and in fact is a bit stronger; instead of a 10% expected increase after the New Year's, we see a drop of 10%.

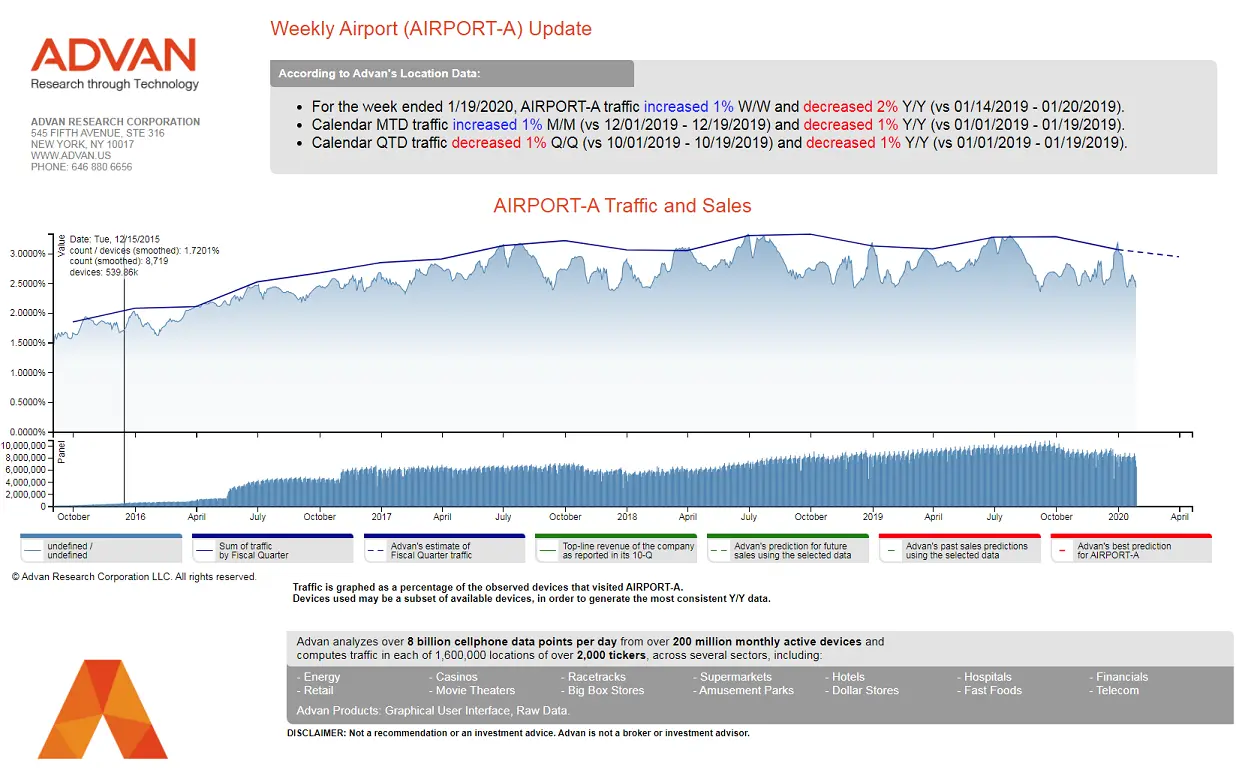

And last, the US airport traffic and how it compares to international airport traffic:

The US airport traffic is the blue line and the Global traffic is the red line in the graph:

The effect so far has been failry muted when it comes to global or US airport traffic. The measurements are within the margin of error and do not indicate any panic or concern. Of course things change, and fast, and we are monitoring the situation daily, but so far any effects appear to be concentrated in and around China.