Snack & Beverages Under Pressure As Consumer Cuts Visits Into The C-Store

Given the deterioration in traffic and conversion at C&G stores since October, as shown in the chart above, it wasn’t a surprise to see weak results and guidance by PepsiCo this week. CEO Laguarta in the press release was quoted as saying, “Looking ahead to 2025, we will [be] taking actions to improve performance in North America. Our multiyear productivity initiatives will help fund disciplined commercial investments and aid our profitability. Therefore, we expect to deliver low-single-digit organic revenue growth and mid-single-digit core constant currency EPS growth in 2025.” (That level of growth is below their long-term algo, specifically +4-6% on revenue and +HSD on EPS) For the quarter, Frito-Lay North America (FLNA) organic volume / revenue was soft at -3% / -2%. PepsiCo Beverages North America was soft as well at -3% volume / flat in revenue.

Addressing the softness at FLNA, Laquarta said, “We believe the cumulative impacts of inflationary pressures and higher borrowing costs on consumer budgets, difficult laps from above-trend salty and savory category growth in previous years and continued growth in away-from-home dining and experiential spending have impacted our categories and broader packaged food.” As a reminder, FLNA has taken +42% price/mix since 2019, well ahead of the +27% increase in food-at-home CPI, and anyone visiting a 7-Eleven or Circle K store in recent years will know that snack and soft drinks in those stores have become a lot more expensive than the categories in general, especially versus the club and mass channel.

To address the value perception for FLNA, Laquarta intends to invest back into price (i.e. lowering certain prices) and adding lower-priced items onto retailer shelves (i.e. SKUs), saying, “I think when we talk to consumers, value is the #1 decision-maker, and it's the reason why the category slowed down in the last 12 months. So we think that addressing value, giving the consumers' choices at different price points, different solutions throughout the month, the consumers will be making choices as they're trying to maximize their disposable income. So I think that continues to be the #1 focus.” In addition to seeing better reported results, a leading measure of success would be more trips into convenience stores and an improvement in the conversion ratio shown in the chart above. Advan Research will be watching. (We’re also available to discuss other methods of monitoring the industry and PEP.)

The Walt Disney Company – Things are Looking Up

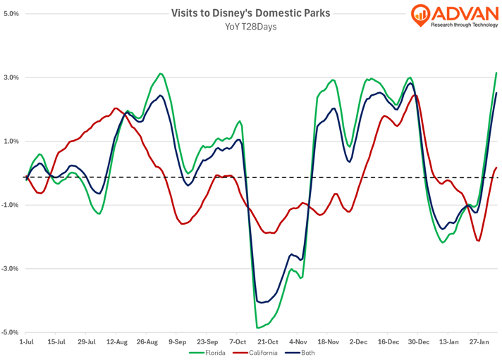

Despite an uneven economy, an unfavorable calendar shift (the late Thanksgiving), and two major hurricanes, The Walt Disney Company was delivered decent results for its domestic parks business, with attendance down only -2% vs. (flat in Q3), food & beverage spend up +4%, and booked rooms even. All figures being roughly in-line with Advan’s data which measured traffic slower by 70bps QoQ. The graph above shows the impact of the hurricanes in October and Thanksgiving; it also shows that the business was strong exiting January.

Focusing on just Anaheim (as the hurricanes distort the figures), visitors and time spent at the parks were up +1%. (We are filtering for visits that are over 1 hour in duration and only during opening hours.) Our data also shows that longer stays were the trend and that visits were driven by those with greater than $100K in household income. Those dynamics support the +4% increase in food & beverage. These trends, along with solid summer season bookings, likely gave management the confidence to say that they “certainly feeling positive” about the business and to our ears their tone had much improved. (Recall last August that they shared that the business had softened.)

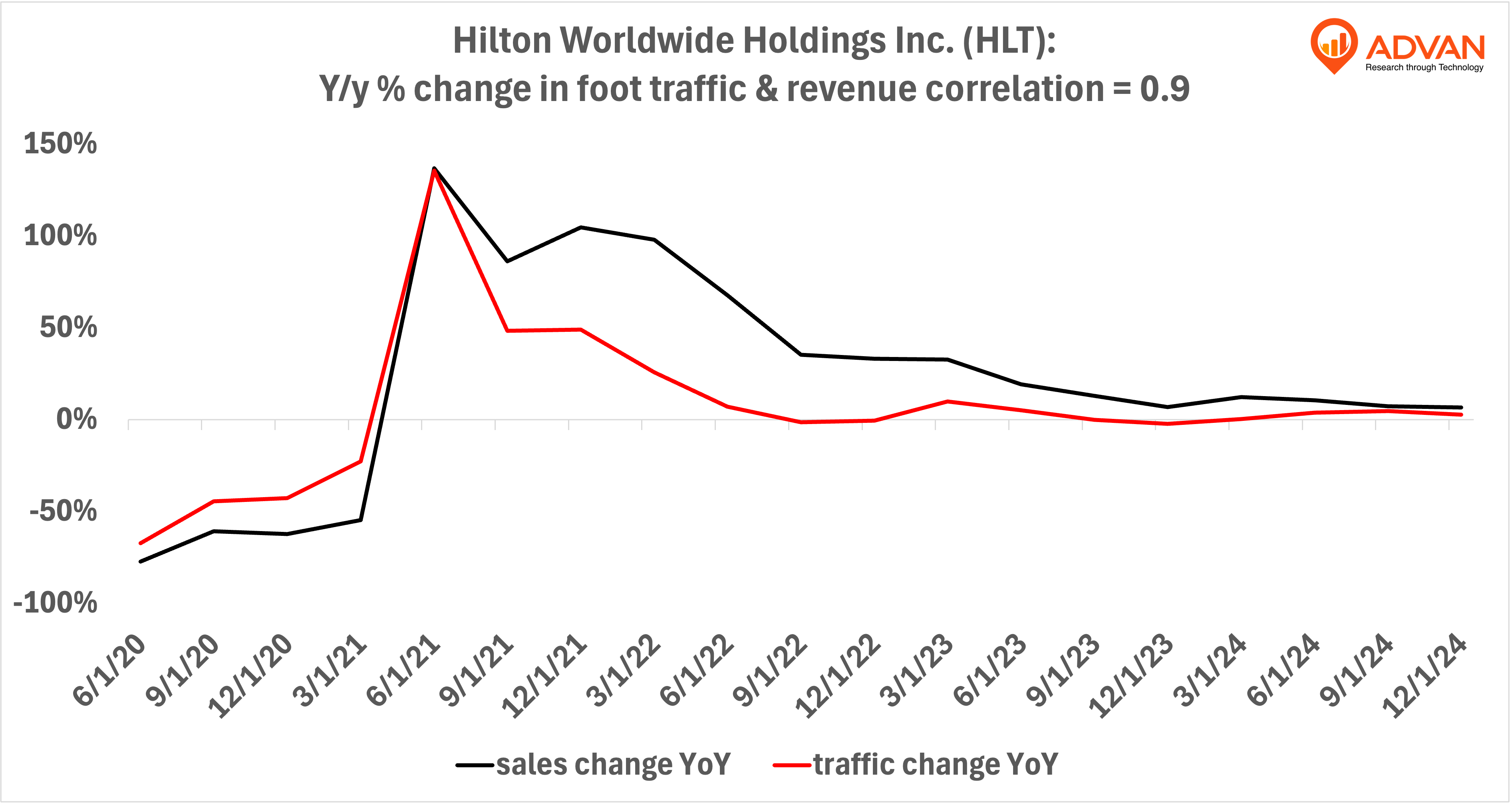

Notable Hit 1: (HLT:NYSE) On Thursday February 6, 2025 Hilton Worldwide Holdings Inc. (HLT) posted revenue of $2.78 bn exceeding the analysts estimates by 1.2%, aligning with Advan's projected sales. Advan's data indicated a 3% increase YoY in visits to Hilton's portfolio of hotels in Q4 2024; the company's revenue grew 6.5% YoY. As a result of beating revenue and earnings, coupled with signs of growing tourism, the stock closed up 5% from previous close. Advan's footfall data has demonstrated 0.9 correlation on a YoY basis with HLT's top-line revenue over the last 19 quarters.

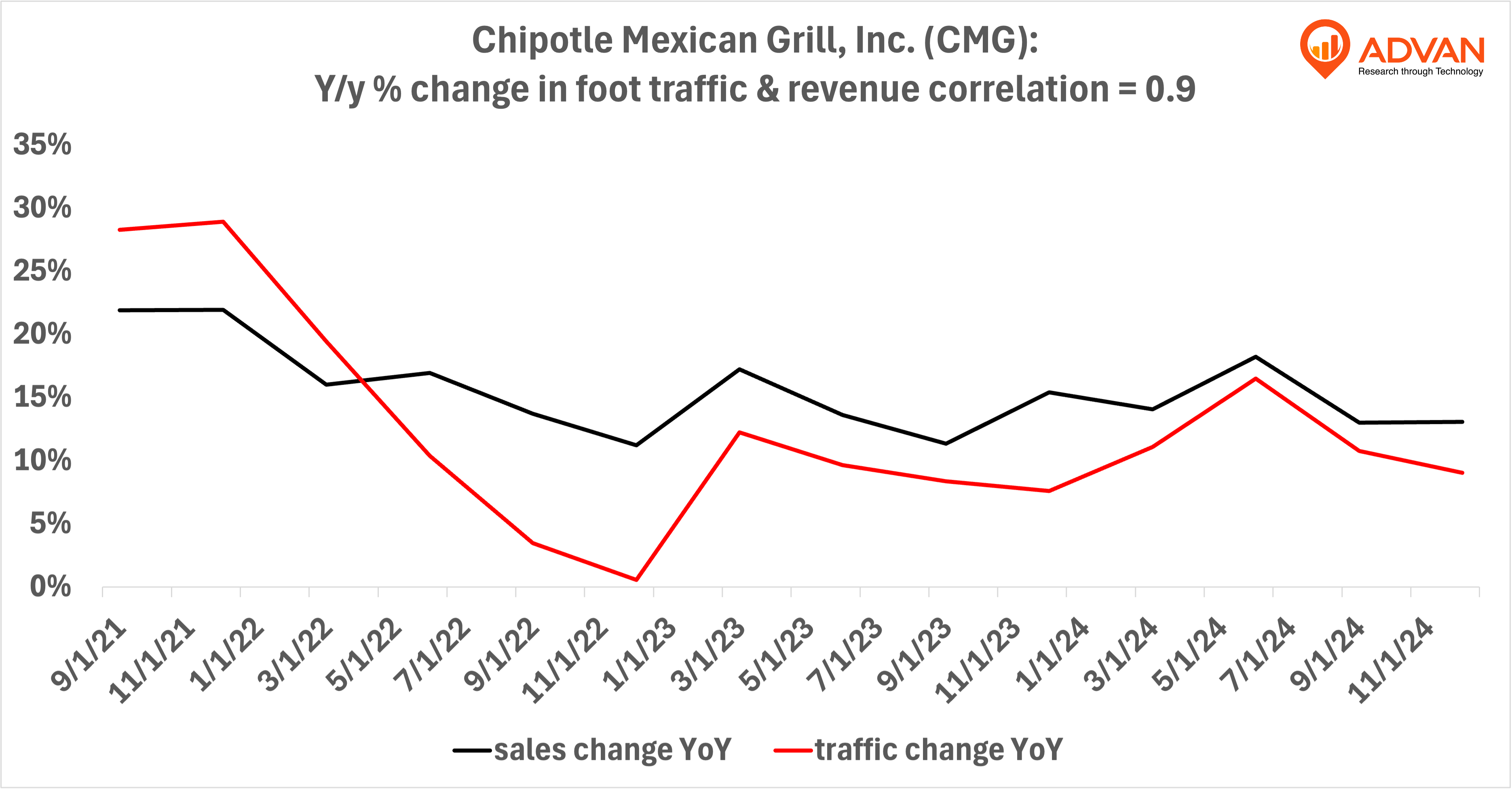

Notable Hit 2: (CMG:NYSE) On Tuesday February 4, 2025 Chipotle Mexican Grill, Inc. (CMG) reported $2.78 bn revenue slightly exceeding the analysts' estimates by 0.2%, aligning with Advan's projected sales. Advan's data indicated a 9% increase YoY in visits to Chipotle's locations during Q4 2024 while the company's revenue grew 13.1% YoY. Despite surpassing revenue and earnings expectations, the stock opened lower the following day as investors expressed concerns over slowing growth and the potential financial impact of new tariffs. Advan's footfall data has demonstrated a 0.9 correlation on a YoY basis with CMG's top-line revenue over the last 19 quarters.