Notable Hit 1: (RRR:NASDAQ) On Tuesday February 11, 2025 Red Rock Resorts, Inc. (RRR) posted revenues of $495.7 mm surpassing the analysts estimates by 0.82% and closer to Advan's implied sales of 492.5 mm (-0.61%). Advan's data showed a 10.1% increase YoY in foot traffic to its resorts in Q4 2024; the company's revenue increased 7.1% YoY. As a result of beating revenue and earnings as well as the declaration of quarterly dividends, the company's stock next day opened 4.3% up from previous close. Advan's footfall data has a correlation of 0.95 on a YoY basis with RRR's top-line revenue over the last 20 quarters.

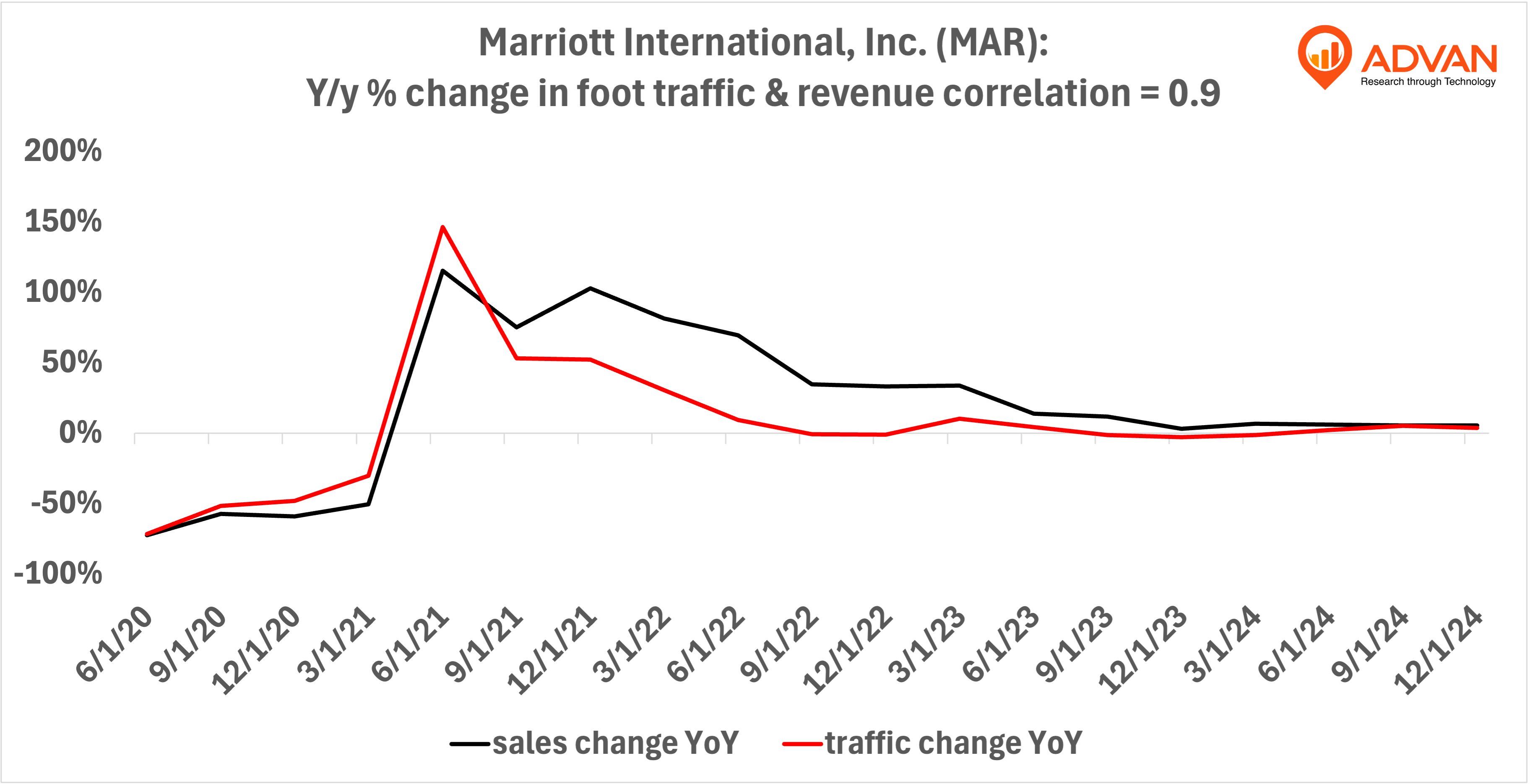

Notable Hit 2: (MAR:NASDAQ) On Tuesday February 11, 2025 Marriott International, Inc. (MAR) posted revenues of $6.43 bn surpassing the analysts estimates by 0.99% and closer to Advan's implied sales of 6.38 mm (-0.83%). Advan's data showed a 3.5% increase YoY in foot traffic overall across all hotel chains in Q4 2024; the company's revenue increased 5.5% YoY. Despite reporting a strong quarter results, the stock declined over 4% as investors are cautious over its future outlook. Advan's footfall data has a correlation of 0.9 on a YoY basis with MAR's top-line revenue over the last 19 quarters.

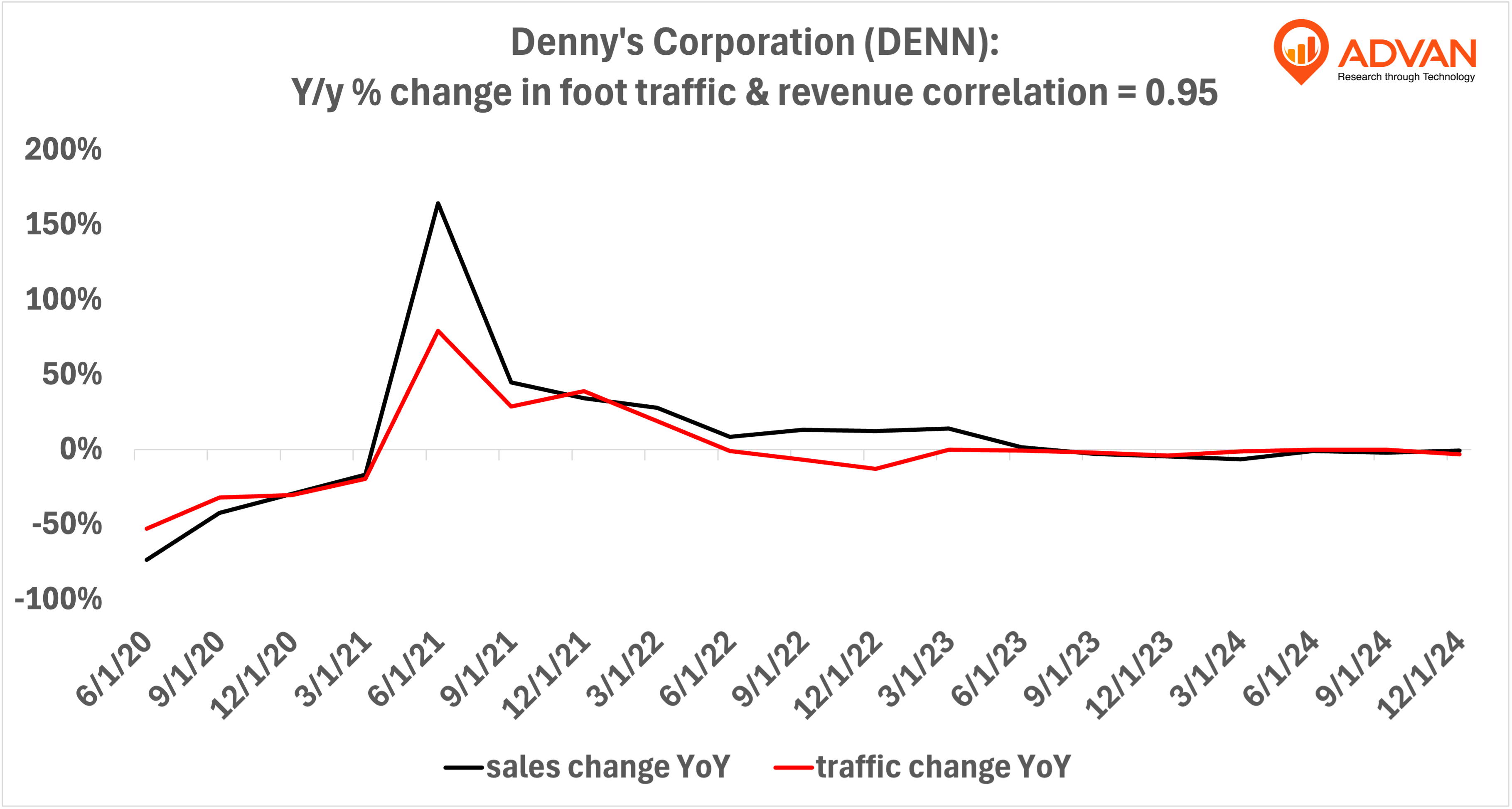

Notable Hit 3: (DENN:NASDAQ) On Wednesday February 12, 2025 Denny's Corporation (DENN) posted revenues of $114.67 mm missing the analysts estimates by 0.47% and in the same direction of Advan's implied sales. Advan's data showed a 3% decrease YoY in foot traffic to its restaurants in Q4 2024; the company's revenue decreased 1% YoY. Denny's has been experiencing profitability issues over the past four quarters forcing it to close about 90 locations; as a result of missing revenue and earnings, the stock closed down 23% from previous close. Advan's footfall data has a correlation of 0.95 on a YoY basis with DENN's top-line revenue over the last 19 quarters.