Notable Hit 1: (SHAK:NYSE) On Wednesday October 30, 2024 Shake Shack Inc. (SHAK) posted revenues of $316.9 mm surpassing the mean analysts estimates by 0.3% and in the same direction as Advan's forecasted sales. Advan's data showed a 15.7% increase YoY in foot traffic to its restaurants in Q3 2024; the company's revenue increased 14.7% YoY. The stock next day closed up +7.8% from previous close. Advan's footfall data has a correlation of 0.96 on a YoY basis with SHAK's top-line revenue over the last 19 quarters.

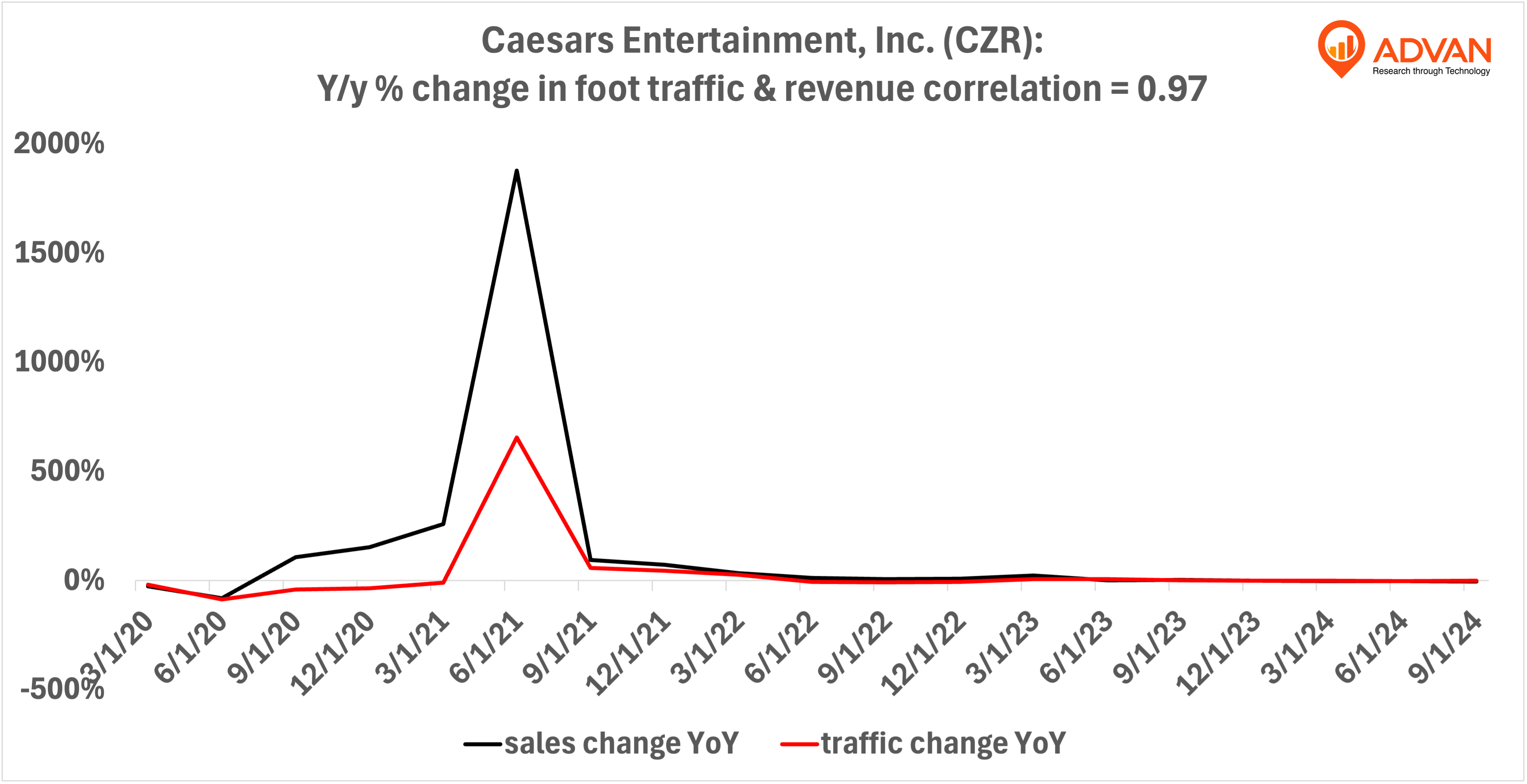

Notable Hit 2: (CZR:NASDAQ) On Tuesday October 29, 2024 Caesars Entertainment, Inc. (CZR) posted revenues of $2.874 bn missing the mean analysts estimates by 2.2% and in the same direction as Advan's forecasted sales. Advan's data showed a 1% decrease YoY in foot traffic to its casinos in Q3 2024; the company's revenue decreased 4% YoY. The stock next day was down 8.2% from previous close. Advan's footfall data has a correlation of 0.97 on a YoY basis with CZR's top-line revenue over the last 19 quarters.

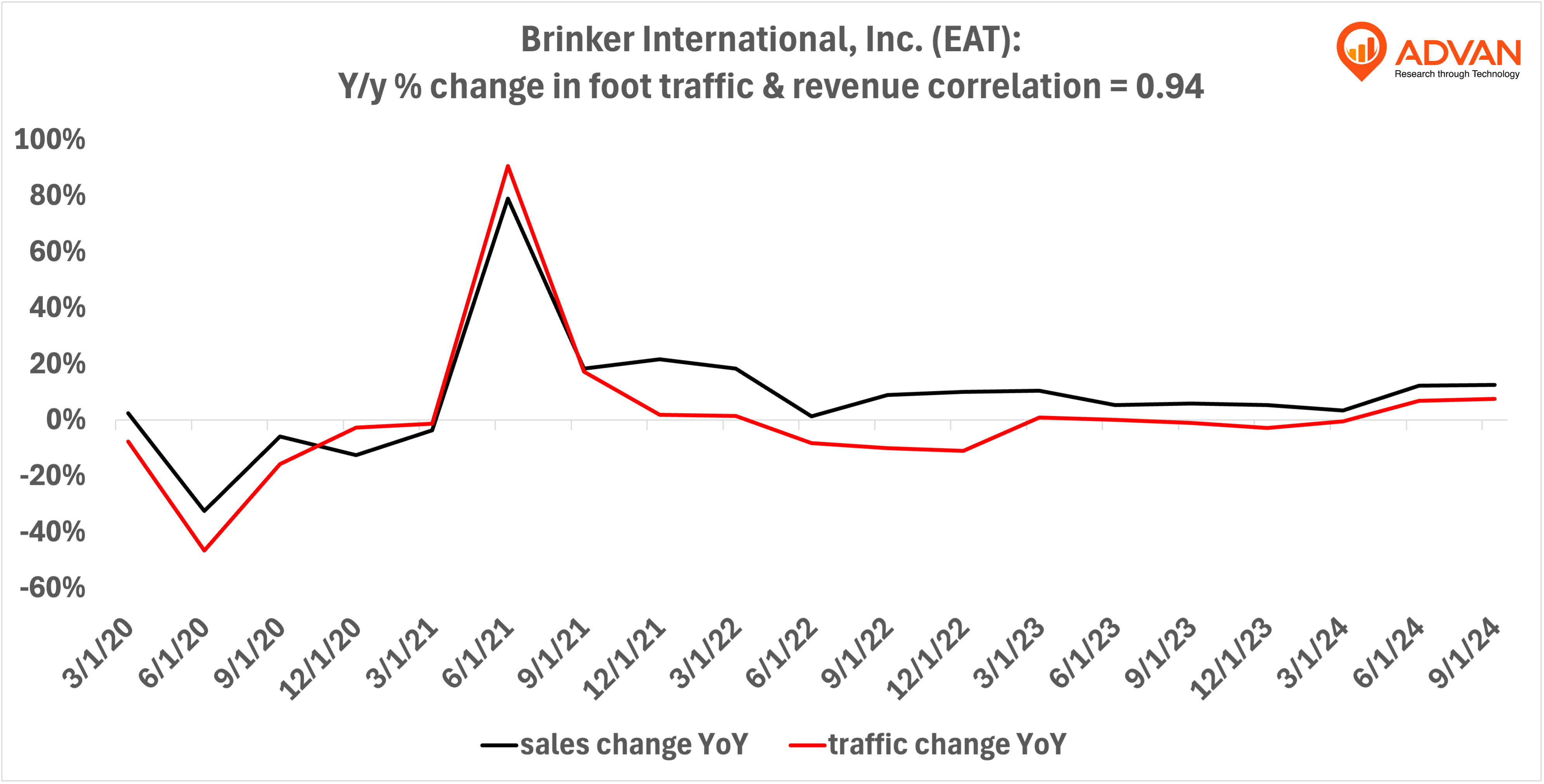

Notable Hit 3: (EAT:NYSE) On Wednesday October 30, 2024 Brinker International, Inc. (EAT) posted revenues of $1.139 bn surpassing the mean analysts estimates by 4.5% and in the same direction as Advan's forecasted sales. Advan's data showed a 7.6% increase YoY in foot traffic to its restaurants in Q3 2024; the company's revenue increased 12.5% YoY. The stock next day closed up 7.5% from previous close. Advan's footfall data has a correlation of 0.94 on a YoY basis with EAT's top-line revenue over the last 19 quarters.