Notable Hit 1: (THO:NYSE) On Wednesday June 5, 2024 THOR Industries, Inc. (THO) posted revenues of $2.8 bn missing the analysts estimate by 12% and in the same direction as Advan's forecasted sales. Advan's data showed a 2.9% decrease YoY in foot traffic to its manufacturing facilities in Q1 2024; the company's revenue decreased 4.3% YoY. As a result, the stock opened down 2.5% from previous close. Advan's footfall data has a correlation of 0.99 on a YoY basis with THO's top-line revenue over the last 17 quarters.

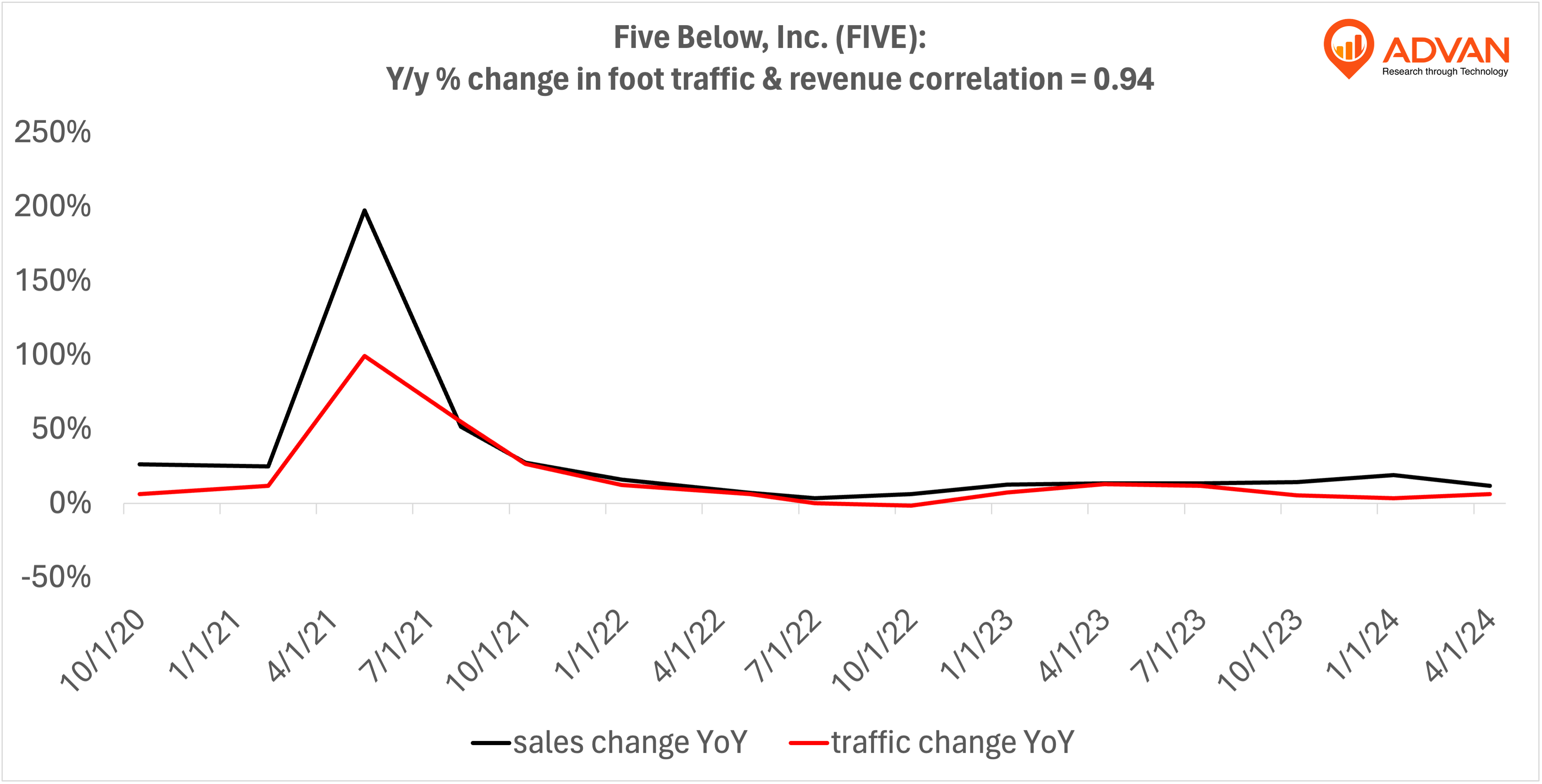

Notable Hit 2: (FIVE:NASDAQ) On Thursday May 30, 2024 Five Below, Inc. (FIVE) posted revenues of $811.9 mm missing the analysts estimate by 3.3% and in the same direction as Advan's forecasted sales. Advan's data showed a 6.2% increase YoY in foot traffic to its stores in Q1 2024; the company's revenue increased 11.8% YoY. Advan's footfall data has a correlation of 0.94 on a YoY basis with FIVE's top-line revenue over the last 15 quarters.

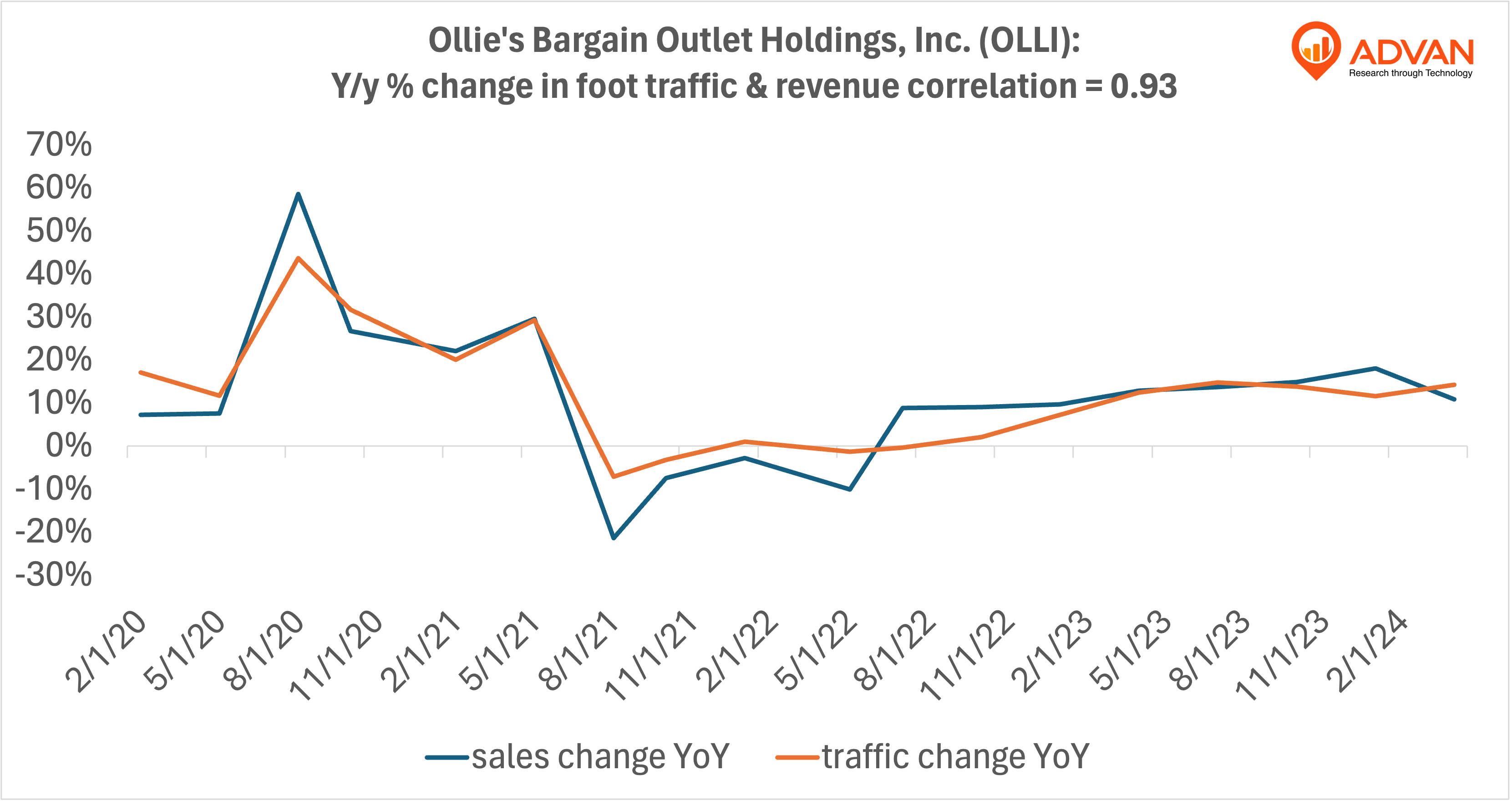

Notable Hit 3: (OLLI:NASDAQ) On Wednesday June 5 2024 Ollie's Bargain Outlet Holdings, Inc. (OLLI) posted revenues of $508.82 mm surpassing the analysts estimate by 6.6% and in the same direction as Advan's forecasted sales. Advan's data showed 11.9% increase YoY in foot traffic to its stores in Q1 2024; the company's revenue increased 10.8% YoY. As a result, the stock closed up 9.5% Advan's footfall data has a correlation of 0.93 on a YoY basis with OLLI's top-line revenue over the last 18 quarters.

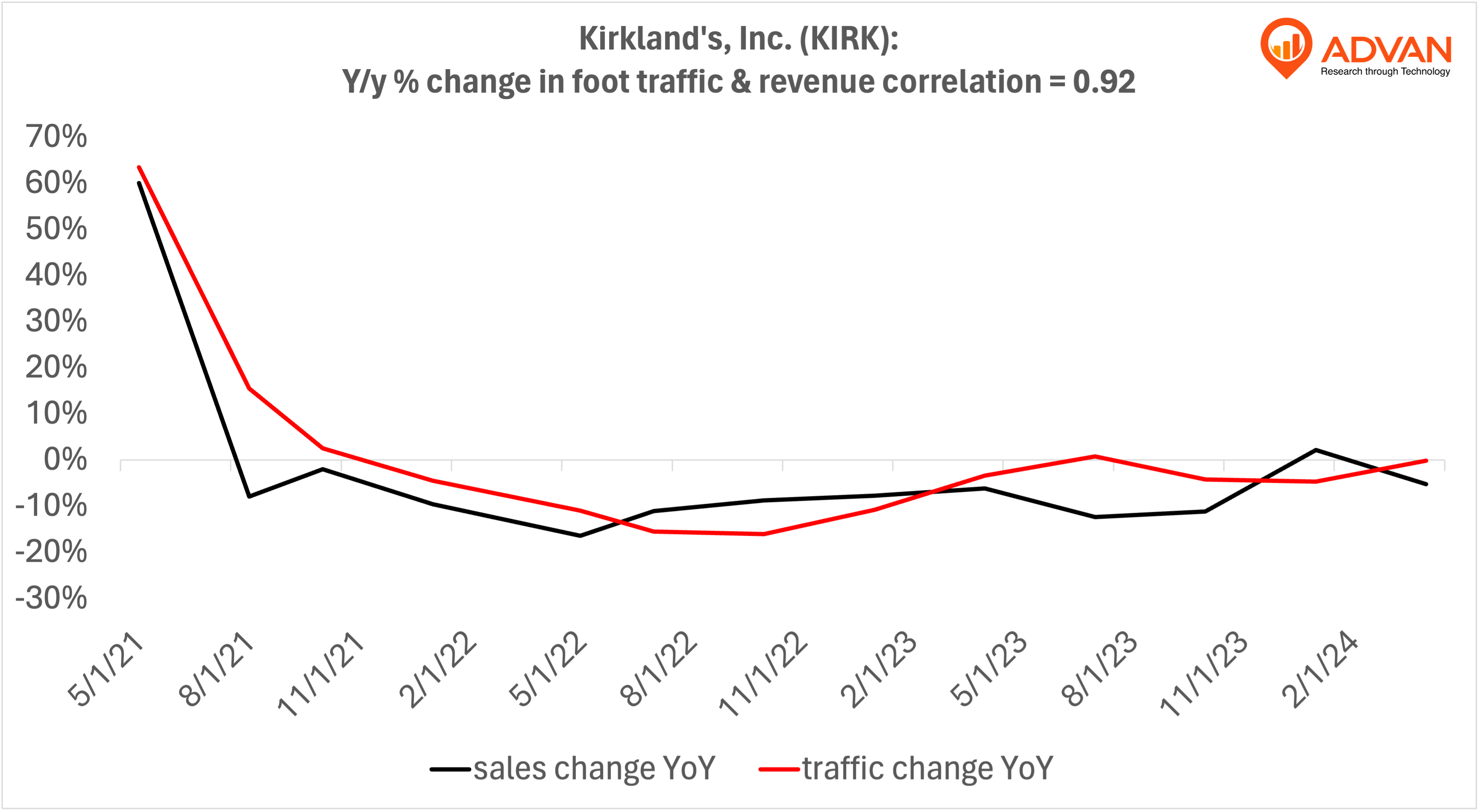

Notable Hit 4: (KIRK:NASDAQ) On Thursday June 6, 2024 Kirkland's, Inc. (KIRK) posted revenues of $91.75 mm missing the analysts estimate by 0.8% and in the same direction as Advan's forecasted sales. Advan's data showed a 0.3% decrease YoY in foot traffic to its stores in Q1 2024; the company's revenue decreased 5.3% YoY. As a result, the stock closed down 14% from previous close. Advan's footfall data has a correlation of 0.92 on a YoY basis with KIRK's top-line revenue over the last 13 quarters.