Notable Hit 1: (THO:NYSE) On Tuesday June 6, 2023 THOR Industries, Inc. (THO) posted revenues of $2.93 bn following the same direction as Advan's forecasted sales. The revenue decreased 37.1% YoY - in line with Advan's foot traffic data increase of 41.8% YoY at its manufacturing facilities in Q1 2023. Advan's footfall data have a correlation of 0.99 on a YoY basis with THO's top-line revenue over the last 13 quarters.

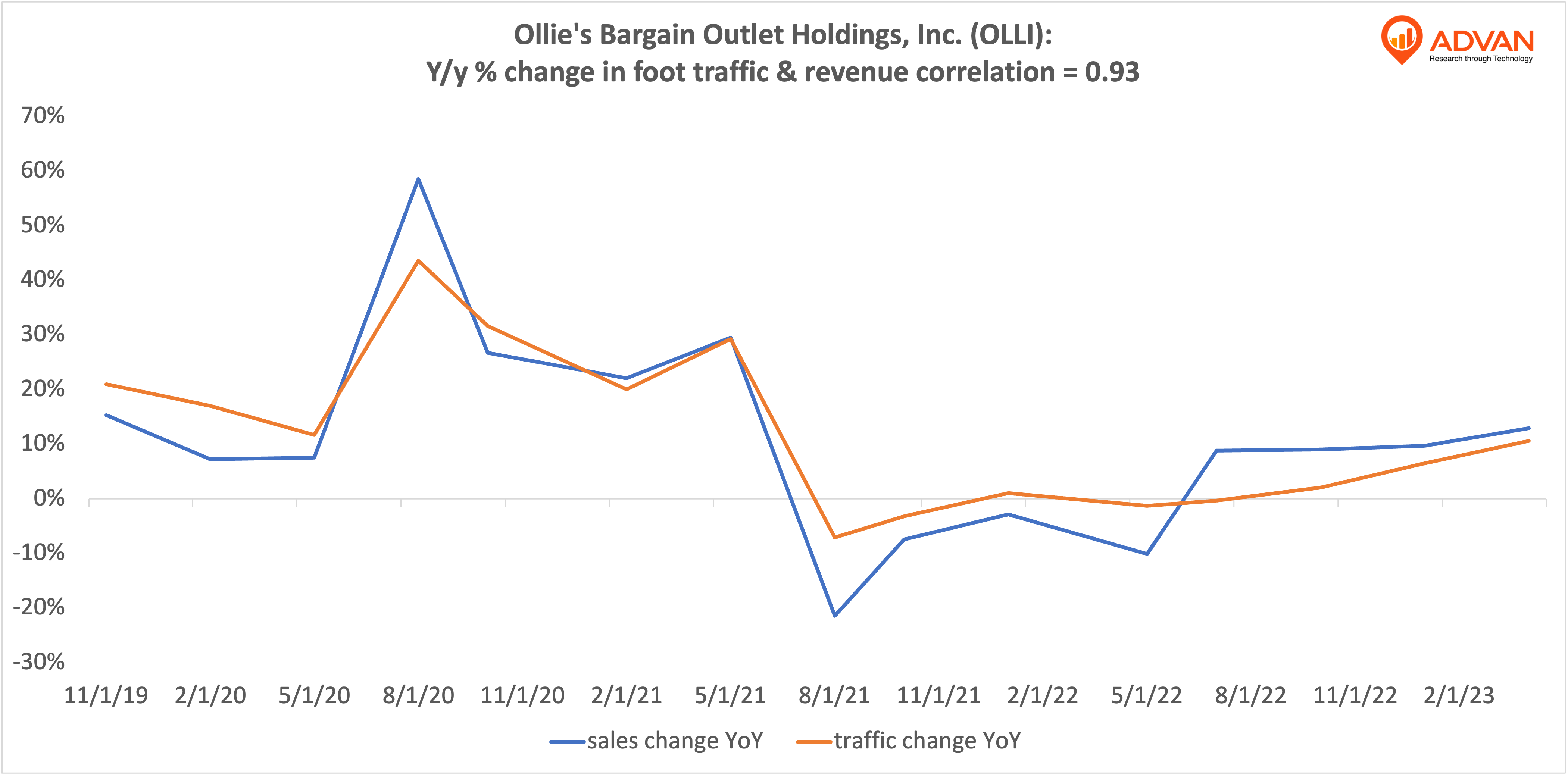

Notable Hit 2: (OLLI:NYSE) On Wednesday June 7, 2023 Ollie's Bargain Outlet Holdings, Inc. (OLLI) posted revenues of $459.15 mm beating the mean analyst estimates by +1.22% and in the same direction as Advan's forecasted sales. The revenue increased 12.9% YoY and in line with Advan's foot traffic data increase of 11.4% YoY at its stores in Q1 2023. Advan's foot traffic data has a correlation of 0.93 on a YoY basis with OLLI's top-line revenue over the last 15 quarters.

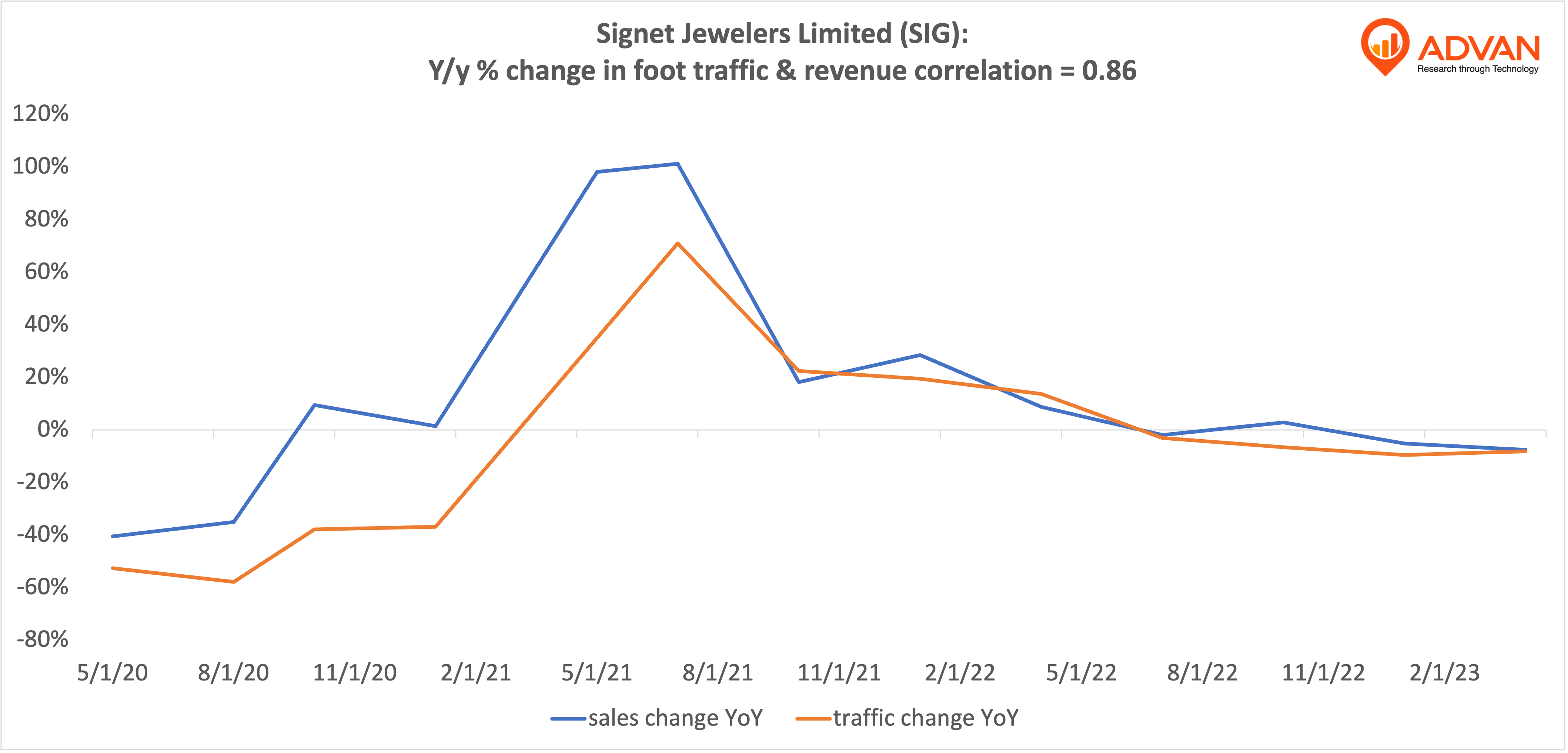

Notable Hit 3: (SIG:NYSE) On Thursday June 8, 2023 Signet Jewelers Limited (SIG) posted revenues of $1.7 bn following the same direction as Advan's forecasted sales. The revenue decreased 9.2% YoY and in line with Advan's foot traffic data decrease of 8.4% YoY at its stores in Q1 2023. The stock opened down 12% from previous close. Advan's vehicle data has a correlation of 0.86 on a YoY basis with M's top-line revenue over the last 13 quarters.