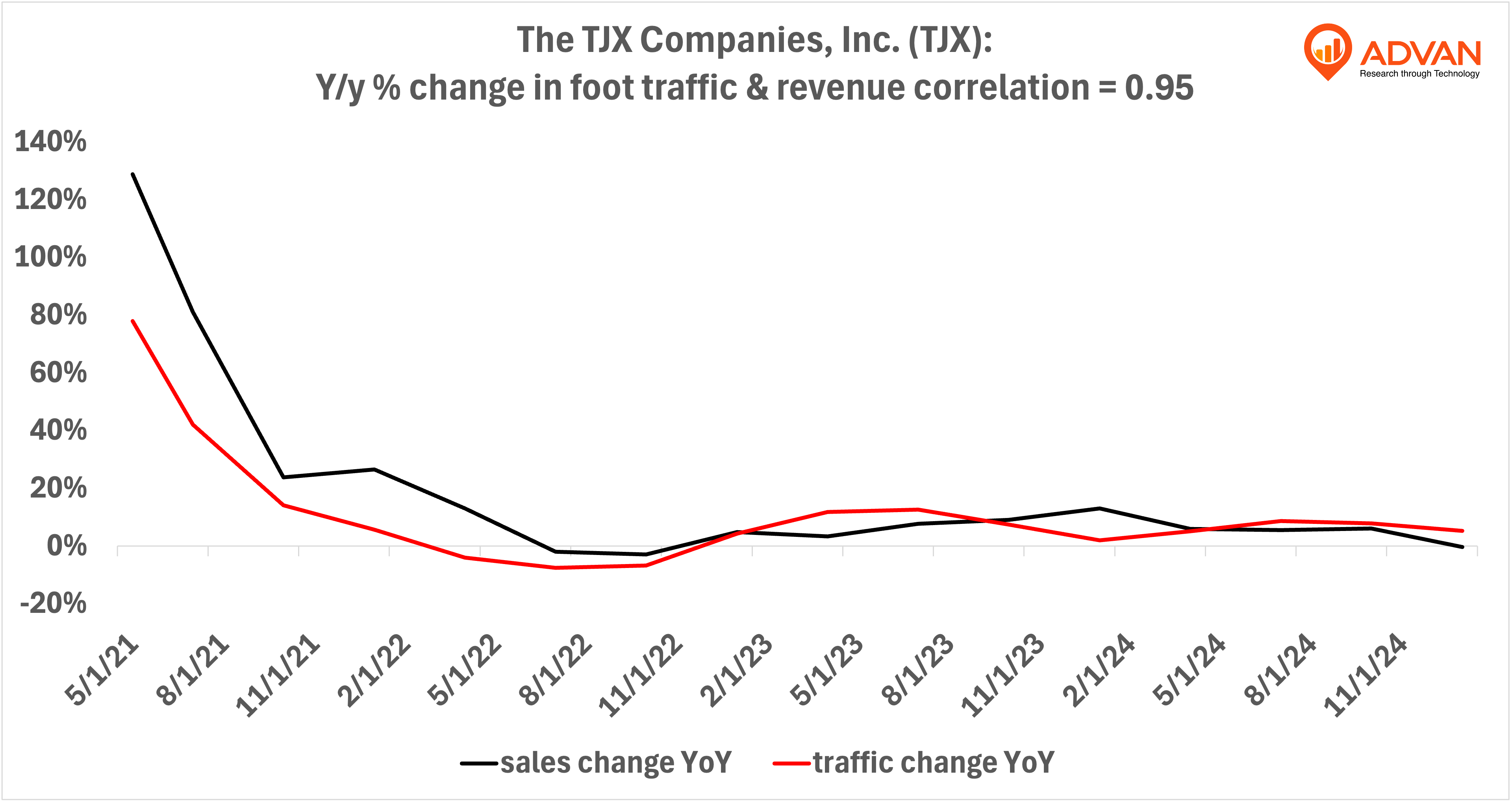

Notable Hit 1: On Wednesday February 26, 2025 The TJX Companies, Inc. (TJX) posted revenues of $16.35BN surpassing the analysts estimates by 1% and in the same direction of Advan's implied sales. Advan's data showed a 5.3% increase YoY in foot traffic to the retailer's stores (subsidiaries such as Marhsalls, HomeGoods also included) in Q4 2024; the company's revenue was slightly down (-0.4%) YoY. The stock moved higher during the trading session. Advan's footfall data has a correlation of 0.95 on a YoY basis with TJX's top-line revenue over the last 16 quarters.

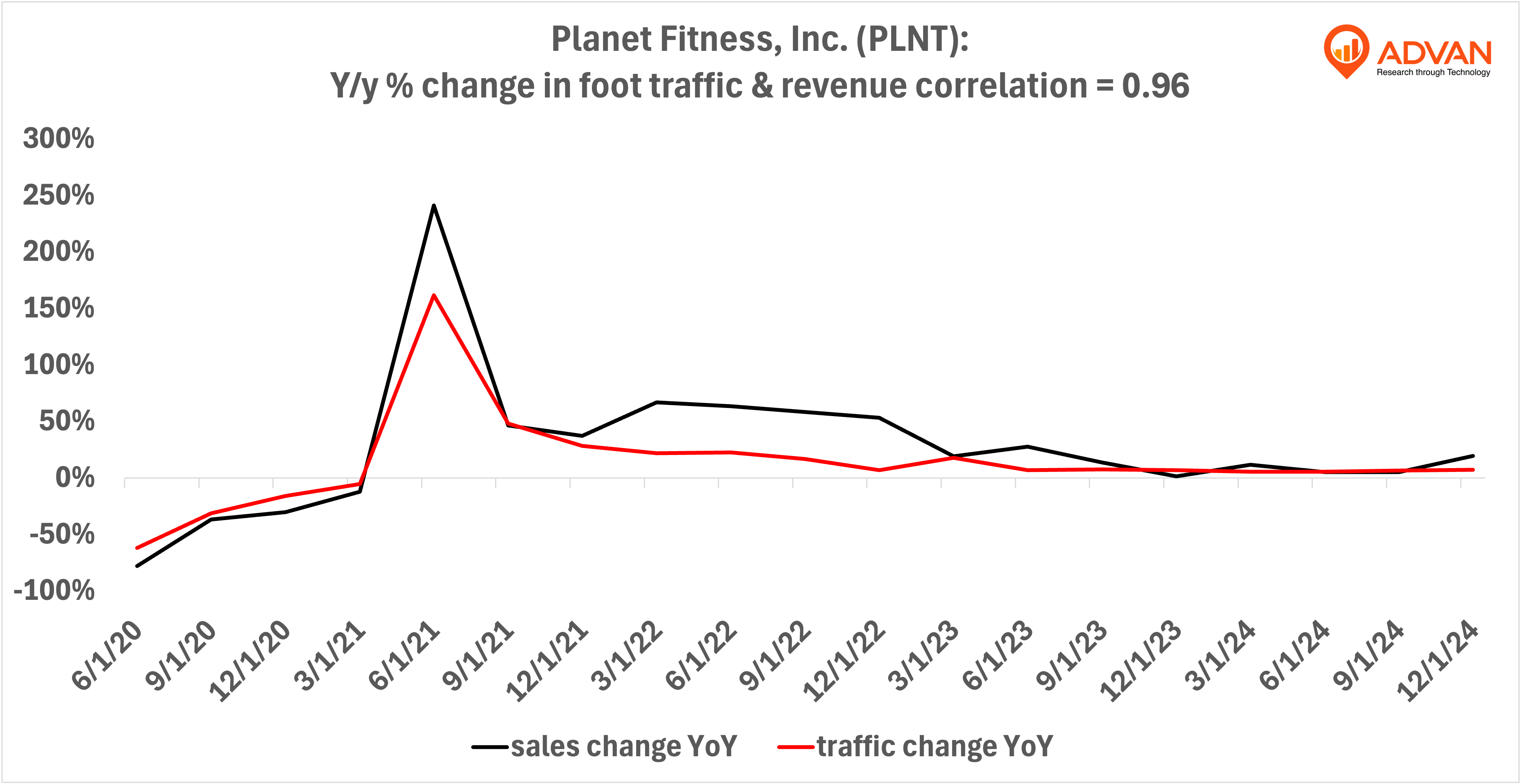

Notable Hit 2: On Tuesday February 25, 2025 Planet Fitness, Inc. (PLNT) posted revenues of $340.5MM surpassing the analysts estimates by 4.8% and in the same direction of Advan implied sales. Advan's data showed a 7.2% increase YoY in foot traffic to the company's fitness centers in Q4 2024; the company's revenue increased 19.4% YoY. The stock however fell. Advan's footfall data has a correlation of 0.96 on a YoY basis with PLNT's top-line revenue over the last 19 quarters.

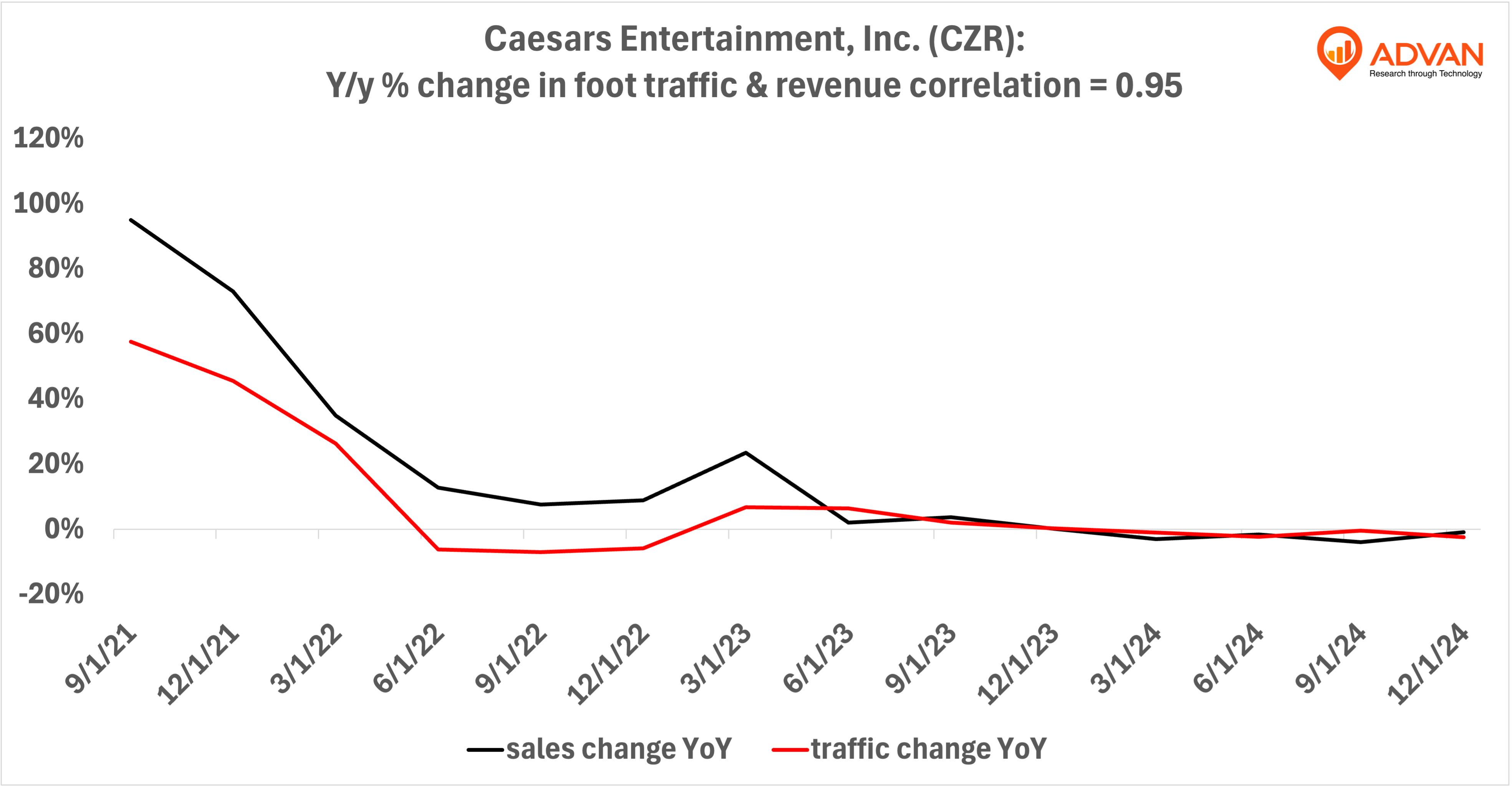

Notable Hit 3: On Tuesday February 25, 2025 Caesars Entertainment, Inc. (CZR) posted revenues of $2.8BN missing the analysts estimates by 3.3% and in the same direction of Advan implied sales. Advan's data showed a 2.4% decrease YoY in foot traffic to the company's casinos in Q4 2024; the company's revenue decreased 1% YoY. The stock next day remained mostly flat. Advan's footfall data has a correlation of 0.95 on a YoY basis with CZR's top-line revenue over the last 15 quarters.