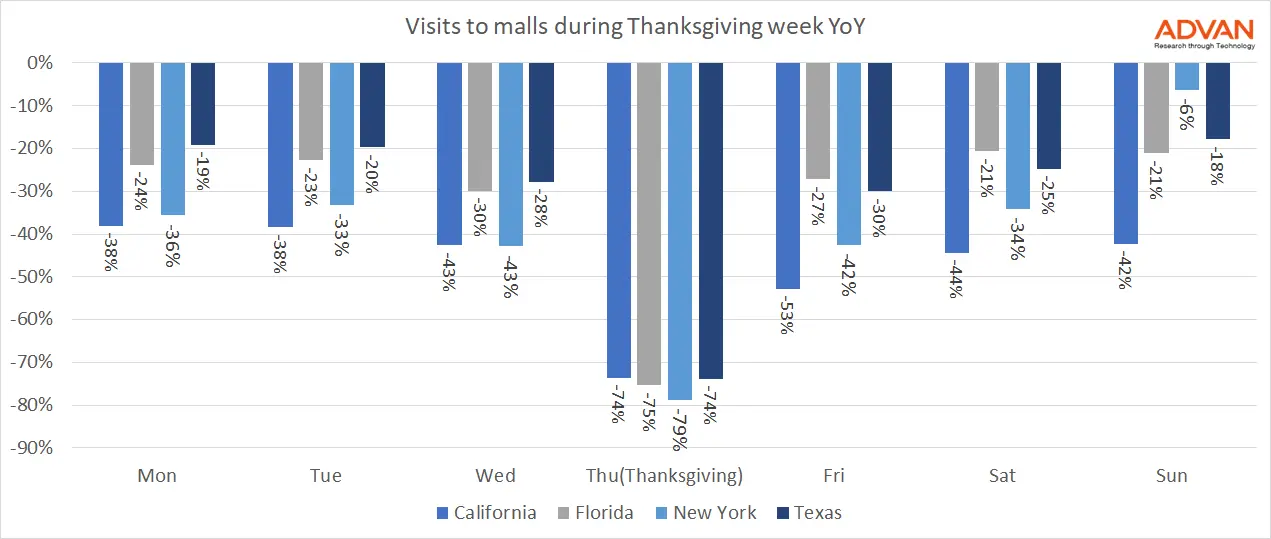

Malls around the US suffered a significant blow during what is usually the busiest shopping weekend of the year. Foot traffic was down 41% year-over-year on Black Friday and 45% on Saturday.

As we reported in our blog post last week, there was a pick-up in traffic during the first three weeks of November as many people opted to take care of their shopping sooner, in order to beat the rush and in anticipation of lock-down orders across the country. Indeed, earlier in the week - Monday through Wednesday - foot traffic was down around 32% on average compared to 2019.

Looking at the data across different states we also see significant differences, with New York and California suffering far greater losses in foot traffic numbers than Florida and Texas. Likely a reflection of differing restrictions to movement as well as consumer attitudes.

Many retailers will have offset the loss in customers at their locations with online spending, which is estimated to be up 22% . But fewer customers in stores means fewer point-of-sale purchases and less spontaneous, unplanned spending as customers focus on bargains available online.

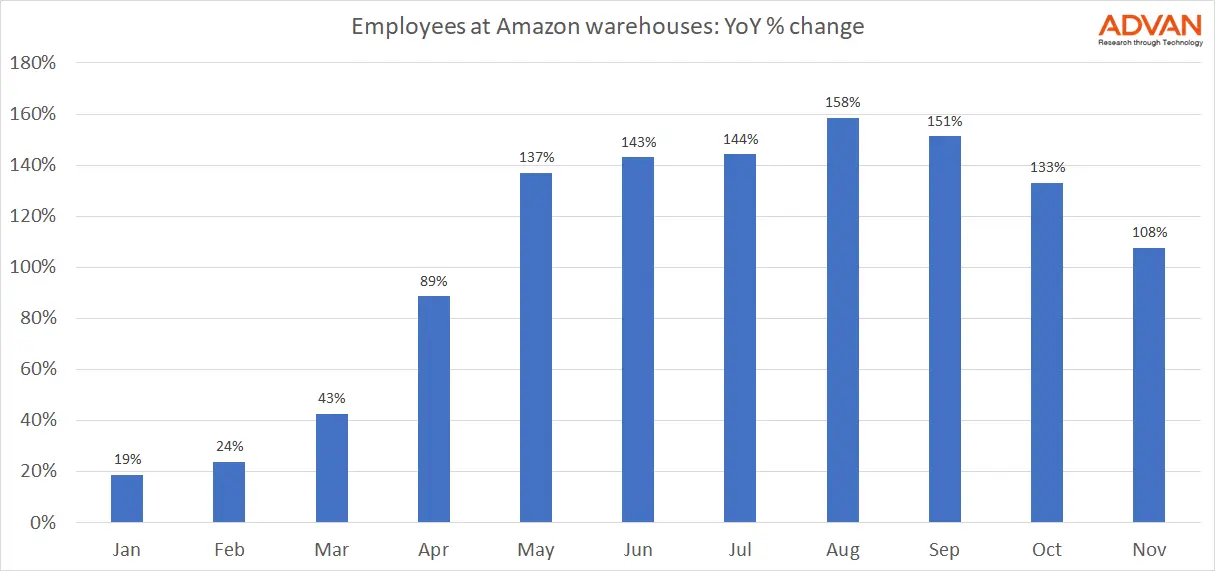

While all retailers have been adjusting and improving their online offerings this year, one consistent winner continues to be Amazon. The behemoth has seen the number of employees in its warehouses up an average of 139% year-over-year each month since May.