By Thomas Paulson, Head of Market Insights

Casey’s General Stores, Inc reported strong quarterly results for its “inside” business with comp-sales on prepared food & dispensed beverages increasing 4.7% and grocery & general merchandise increasing 3.3%. As a reminder, the gas & convenience channel is undergoing a transformation to more fresh and prepared offerings vs. packaged food. Not only does the fresh & prepared allow retailers to create differentiation and capture market share, but the offering also has a much higher gross margin rate at nearly 60% vs. 35% for grocery & merchandise. CEO Darren Robelez said, “Our prepared food and dispensed beverage team continues to do an excellent job innovating and finding the right quality of products to serve our guests. The hot sandwiches launched last year have continued to perform very well. We also had a limited release of new chicken wings and fries in our Des Moines market, with encouraging results so far.”

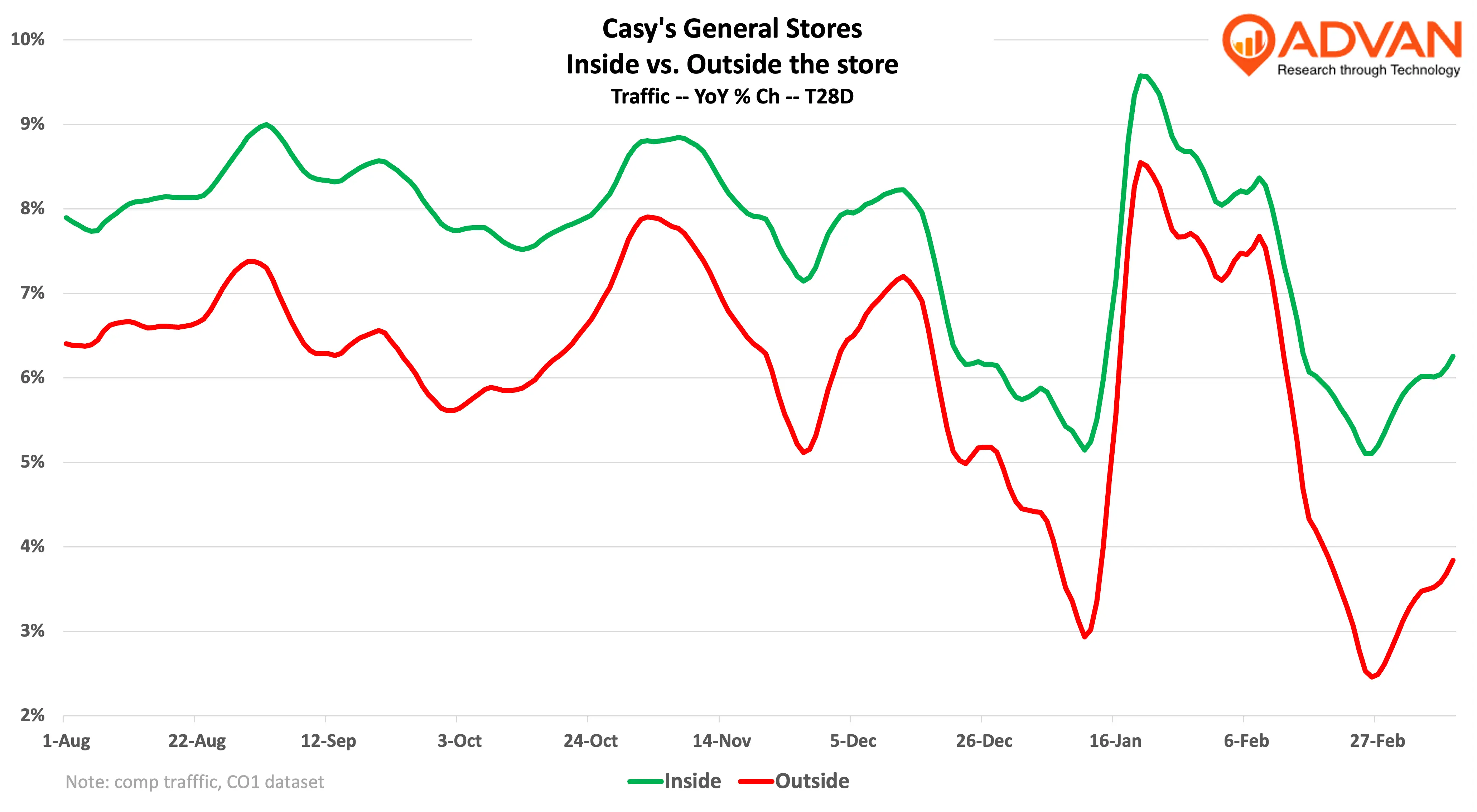

In terms of the “outside” business, same-store gallons sold increased 1.8%. Advan data also shows, the inside slightly outpacing (130 bps) the outside business which also demonstrates that Casey’s efforts to incent inside visits is succeeding. The gap between the comp gallon increase and inside comp-sales (+3.7%) can be attributed to inflation and a slight improvement in the outside-to-inside conversion rate.

On the current consumer malaise, Robelez said, “From a consumer standpoint, I think similar to others, we've seen a little bit of pressure on the lower income consumer. But what I would say is that consumer, and I'll remind you that for those -- we consider a low-income consumer, someone who makes less than $50,000 a year... They are still purchasing. We still see positive growth from those consumers. It's just not at the same rate that we see in the other income cohorts. So, they're still buying just not as much as some of the other cohorts…. With respect to value, like I said, I think we're still in a good spot from a value proposition standpoint when we look at our pizza business… we typically are $1 or more below on a typical menu price versus those competitors

Robelez went on to say, “I don't have specific numbers to share with you on that other than to say February was a tough weather month. And I can tell you when the temperature difference is 50 or 60 degrees colder than the prior year. I mean, you see it in the numbers. And what gives me confidence about this … is that when the weather starts to normalize. We even get back to parity... So, if I wasn't seeing that, I would have other concerns, but it has strictly been tied to those weather events where we have unusual amounts of snow where you had to shut down some stores or just like I mentioned before, those extreme temperature variations. So, I don't have any concern that there's a more fundamental issue with the consumer because they bounce back as soon as the weather clears out.”

Thomas has been Head of Market Insights for Advan Research since January 2025. Previously, he served as Director of Research and Business Development at Placer.ai, where he was instrumental in providing actionable insights derived from location analytics and the path for expansion into new verticals. His extensive background also includes two decades as a Wall Street analyst and portfolio manager in asset management at Alliance Bernstein, Cornerstone, and others. Linkedin profile.