By Thomas Paulson, Head of Market Insights

To say that this is a dynamic time for grocery retail is a classic underbilling given the inflationary spiral coming out of the pandemic, the substantial share-of-stomach lost by conventional brands to private-label led retailers such as Trader Joe’s and Costco, an abandoned merger by Kroger and Albertson’s, and this week’s news of the departure of their CEOs. Before we jump into the earnings results from Kroger, we’d point readers to our recent analysis of the results from Grocery Outlet, Sprouts, and Walmart & Ahold. Also for perspective, Costco’s grocery business comp’ed high-single digits for Kroger’s Q4 period per its reports and Trader Joe’s produced +2% comp-traffic and +6% comp-sales per Advan’s data. Given the industry context, it wasn’t too surprising that Kroger’s 2025 guidance was only 2-3% underlying sales and operating income growth.

Kroger reported comp-sales growth of +2.4% (“ID growth” in their lexicon), or around +1% when excluding the boost from GLP-1 scripts, versus an industry* that grew at +3.4% during the period. Stripping away inflation, pharmacy, and digital orders lowers the store-level comp-units to a -2% decline. Kroger’s CFO Todd Foley said, “Fresh is one of the primary determinants of where customers shop and we continue to invest to offer more days of freshness.” It’s also a macro trend, with fresh gaining 91 bps of share-of-stomach since 2021 to reach 42.0% by year-end**.As produce and private label grew, national branded packaged food units were down mid-single-digits by our estimate (see the share-of-stomach above).

Relatedly, a macro viewpoint of ours is that grocery industry growth will be driven by strong private label brands and the retailers that offer them; that’s a game of scale to get the quality and flavor right. On this front, Foley said, “Our Brands product portfolio in 2024, resulting in more than 90% of customer households purchasing Our Brands items last year. Over time, we built distinct brands that are customer favorites. We're always listening to our customers to understand how we can create more offerings to better meet their needs. Our proprietary customer insights drive our innovation and led to more than 900 new Our Brands products released last year alone, including 370 Fresh items. We look to create destination items that can only be found at Kroger, differentiating ourselves from competitors and national brands.” (So strong support for our viewpoint; lots of promotions to drive that trial were also likely behind the lift. The results release noted that it delivered more personalized value with a 10% increase in digital coupon savings for customers in the year.)

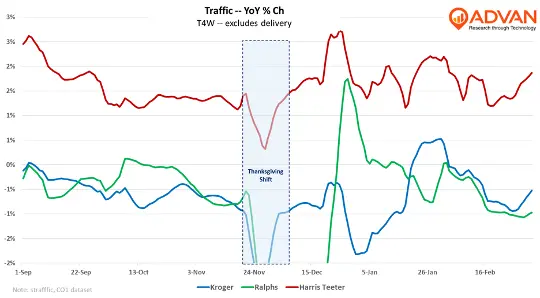

Per Advan, visits, transactions, and spend for the Kroger banner were up slightly. Moreover, these figures also suggest a modest decline in units in the basket, or units per transaction. Declining UPTs is an industry phenomenon as households utilized multiple retailers’ loyalty programs and digital apps to “cherry pick deals” or make a trip to seize a deal. And so, while there is consumer movement and visits from those promotions, those don’t win a full bucket, thus the decline in UPTs. Ralph’s visits slightly grew, but transactions, spend, and implied UPTs were down. By contrast, Harris Teeter produced a 2-3% increase in traffic, transactions, and spend, along with an improvement in implied UPTs.

After some consternation around digital and its Ocado CFC business, digital sales grew +11% to reach $13B in sales and 12% of total sales, excluding gas and RX, by our estimate. Additional evidence of the momentum came earlier this week with the two companies announcing the construction of two new fulfillment centers (or “sheds”) and markets – Charlotte and Phoenix, both to open in 2026. On the business, Foley said, “We've talked a lot over time about some of the things that we're doing inside our sheds and in the last mile relative to our sheds in conjunction with Ocado and working with them to improve that. And so again, we saw it in both spots.

We're not where we want to be, we've alluded to that. We're not where we need to be. But I think the green shoots that we had seen prior to the quarter and the progress we made on those during the quarter, I think, puts us on a trajectory that if we can maintain that consistently and string a few quarters together, I think that will help get us where we want to be over the long term.”

‘* BEA PCE, Table 2.4.5U Personal Consumption Expenditures by Type of Product. ‘** Table 2.4.6U. Real Personal Consumption Expenditures by Type of Product

Thomas has been Head of Market Insights for Advan Research since January 2025. Previously, he served as Director of Research and Business Development at Placer.ai, where he was instrumental in providing actionable insights derived from location analytics and the path for expansion into new verticals. His extensive background also includes two decades as a Wall Street analyst and portfolio manager in asset management at Alliance Bernstein, Cornerstone, and others. Linkedin profile.