By Thomas Paulson, Head of Market Insights

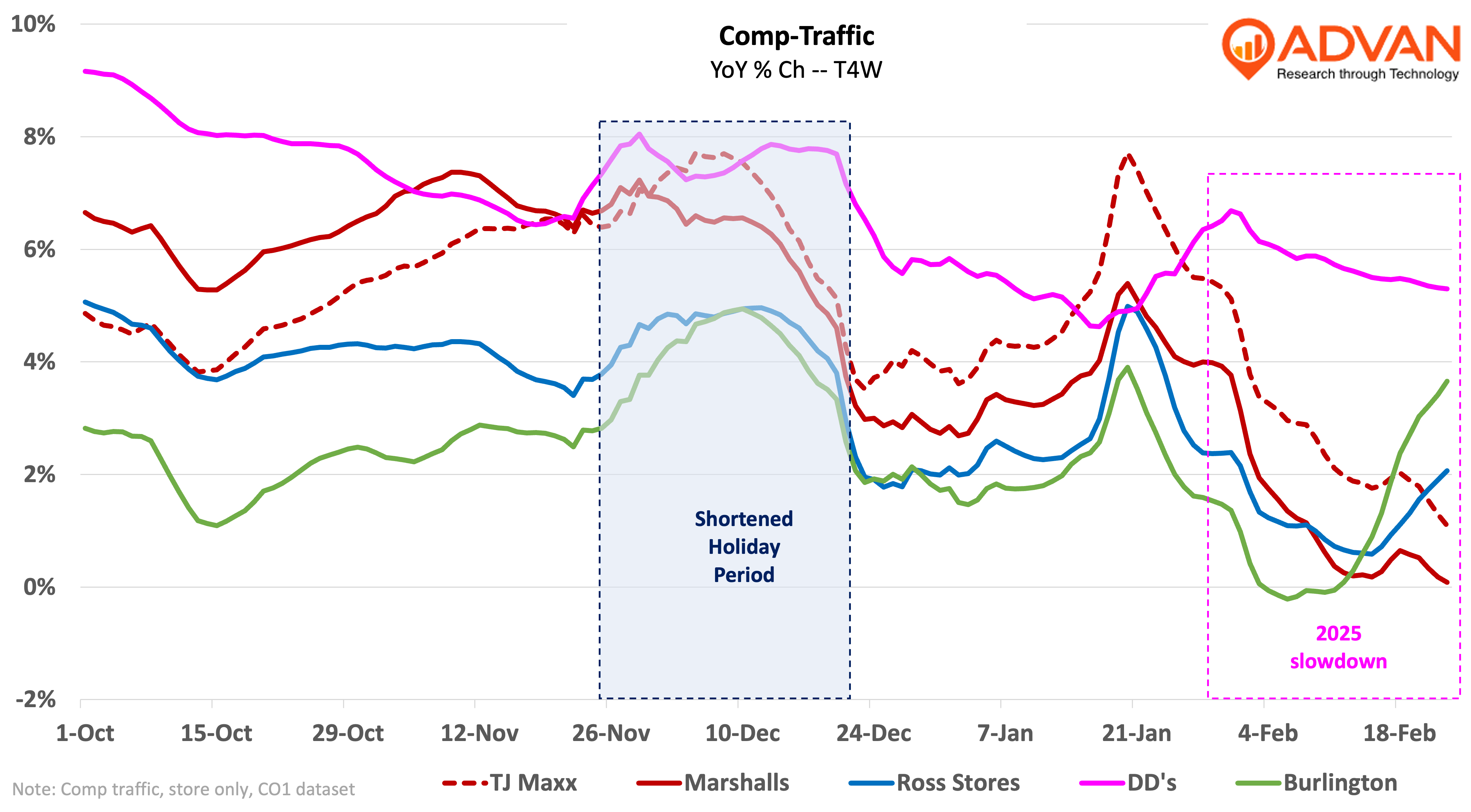

Ross Stores Inc. reported Q4 underlying sales up +3.5% and gross profits and operating income growth less. Sales growth was driven by Ross Dress for Less comp-traffic (+2.8% per Advan), comp-sales growth (+3%), and the new locations added earlier in the fiscal year. Looking at comps on a multi-year basis, all improved, including the comp to 2019 increasing from 17% to 21%. DD’s Discount’s comp outpaced the overall +3% comp and DD’s comp-traffic per Advan increased +6.6%.

Encouragingly for the sector, the pace of traffic picked up for off-price during the holiday period despite fewer days and one less weekend, i.e. there were five fewer days in the period, but traffic grew at an even faster rate meaning that each day produced an even higher level of comparable traffic and transaction growth. This demonstrates that the off-price category was preferenced by consumers when consumers were starved for time. That’s counterintuitive given that off-price is a “treasure hunt” offering that encourages more time for browsing and the absence of a standard and known assortment. Ross Dess for Less saw a +4% increase in average dwell time in December. Moreover, the number of shoppers to Ross on a per-location basis also increased +0.4% on average. However, the number of visits between 30 and 59 minutes increased by +6.7%. For Burlington, the figures are +2.1% in shoppers and +5.2% in the 30-59 window. For T.J.Maxx, the figures are modestly and +4.3%.

Ross management stated that both comp-transactions and “basket size,” or more units in the basket (UPTs) per our read of management’s comments; if true, that would be the first increase in UPTs for the year. Merchandise margin was down 85 bps (large by Ross’ standards) due to an “increased mix of quality branded assortments.” That mix shift also yielded a slight increase in average unit retail (AUR) as well. Given that the totality of comp drivers (traffic, UPTs, and AUR) all increased is a testament of strong execution by the merchant and stores teams.

Ross’ guidance for Q1 and 2025 was soft as expected given the soft January and February macro period, which we’ve covered extensively in prior stories. That guide also set a low bar which we forewarned of in our TJX note. For the fiscal year, guidance was for a +1-2% comp-sales increase, with Q1 down. (+2-3% comps is Ross’ long-term algo.) Incoming CEO Jim Conroy said, “As I reflect on my observations over the past few months, I believe that the brand and merchandising strategies that we have in place for both Ross and dd's are the right ones, and I do not foresee making significant changes to those strategies in the near future. In addition, we have a flexible business model that positions us well to navigate through the current uncertainty, and we will continue to focus on the strong execution of our key initiatives…”

Conroy, “From a marketing standpoint, I'd say it's probably the least developed muscle and least invested in part of the business. So there's probably some opportunity to put the brand on a pencil a bit more and to amplify our messaging in the marketplace to some degree. But I would expect sort of continuing on of the overarching strategies for the two brands.” Our read is that Conroy intends to keep things as they were, save to upweight its marketing, and likely mostly social media – a driver that TJX has leveraged immensely in recent years.

Q4 results from Burlington were much stronger than market expectations with revenue up +10%, comp-sales up +6%, gross margins up 30 bps, and operating income up +6%. (We had pegged comps at +3%.) The improvement in comps vs. 2019 was stunning, going from mid-single-digit increases in the prior three quarters to up +12%. Burlington’s guidance for the quarter was around a +1% increase and CEO Michael O’Sullivan provided the following explanation for the outperformance. However, the net is that AUR really increased (+mid-single-digits) on more better and best brands entering the assortment and being put into the basket, i.e. it’s the same driver that drove Ross’ outperformance. Again, a testament to strong execution by its merchant and store teams. (UPTs and conversion rate were flattish, comp-traffic increased.)

O’Sullivan, “Firstly, in early 2024, we embarked on a strategy to elevate our assortment. In some categories and at some price points, this involved a higher mix of well-known national brands. For sure, this higher mix was important, but this strategy was not just about brands. In other categories or price points, we elevated the assortment in other ways, perhaps through higher quality or a higher fabric or more up-to-date fashion or more embellishment. Depending on the category or price points, these are all characteristics that the customer uses to assess value. Another very important aspect of this strategy was to identify items to remove from the assortment. One of our senior merchants uses the phrase Eliminate to Elevate. This means pruning items from the assortment that do not deserve to be there because the quality or the fashion or the value is just not good enough. We want everything to count. It is also very important to make the point that this elevation strategy was pursued within the framework of a good backup best assortment. We went after opportunities to elevate the assortment at all price points, paying close attention to the need for a deal as well as for wanting to deal with the shopper. We drove this elevation strategy throughout last year, but it was most evident and powerful in the fourth quarter. I interpret our 6% comp sales growth in Q4 as just the customer telling us that they approved of this strategy and really loved our assortment.

The second driver of our strong Q4 performance was that we were very nimble, flexible and responsive to trends in Q4 and throughout the fall season. Let me illustrate this by talking about the quarterly trend last year. In the summer, as we exited Q2, we were flying. We reported 5% comp growth for the quarter, and the trend continued to accelerate, grew Back to School. Then it dropped off significantly due to unseasonably warm weather from mid-September onwards. These warmer temperatures hurt our sales of outerwear and at that particular time of year, outerwear is a critical business for us. The warm weather and the weak trend persisted until mid-November. And then our business took off as the customers began to shop for holiday. I cannot overstate how pleased I am with how well we reacted to this volatility in sales. We chased the trend in back-to-school categories in the summer, then pulled back very hard on cold weather businesses from mid-September onwards, and then chased holiday businesses in late November and December. This nimble and rapid execution is the essence of off-price.”

Thomas has been Head of Market Insights for Advan Research since January 2025. Previously, he served as Director of Research and Business Development at Placer.ai, where he was instrumental in providing actionable insights derived from location analytics and the path for expansion into new verticals. His extensive background also includes two decades as a Wall Street analyst and portfolio manager in asset management at Alliance Bernstein, Cornerstone, and others. Linkedin profile.