This week in our Covid-19 report using foot traffic data from Advan we examine the impact of the virus on student housing. We looked at three student housing buildings, located in College Station (Texas A&M), Boulder (University of Colorado) and Syracuse. All three universities sent students home and switched to online learning in mid-March. Knowing how quickly tenants reacted to the shutdown and when they come back allows owners, operators and leasing agents to make focused decisions that could potentially enhance value and lead to outperformance.

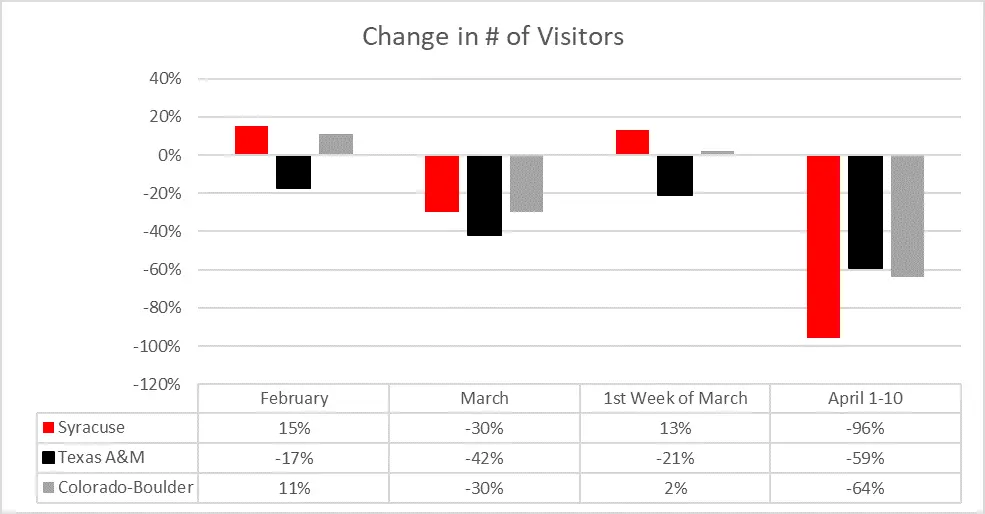

Foot traffic for the property near Texas A&M fell between December and February, so the particular property was already facing challenges from other factors. The properties near Syracuse and Boulder saw significant increases in February and were both up the first week of March.

Unfortunately, due to differences in the timing of spring break this year and last and the time that each school transitioned to online learning, the first week of March is the only week that permits valid year over year (yoy) comparisons. All three schools had yoy declines of 30% or more.

By early April -- as schools continued online learning, states, cities and counties imposed more restrictions, and society worked to bend the curve -- foot traffic fell by more than 50% at all three properties. At the Syracuse property, foot traffic fell 96%! Some students remained at the properties near the other two schools, but clearly not many.

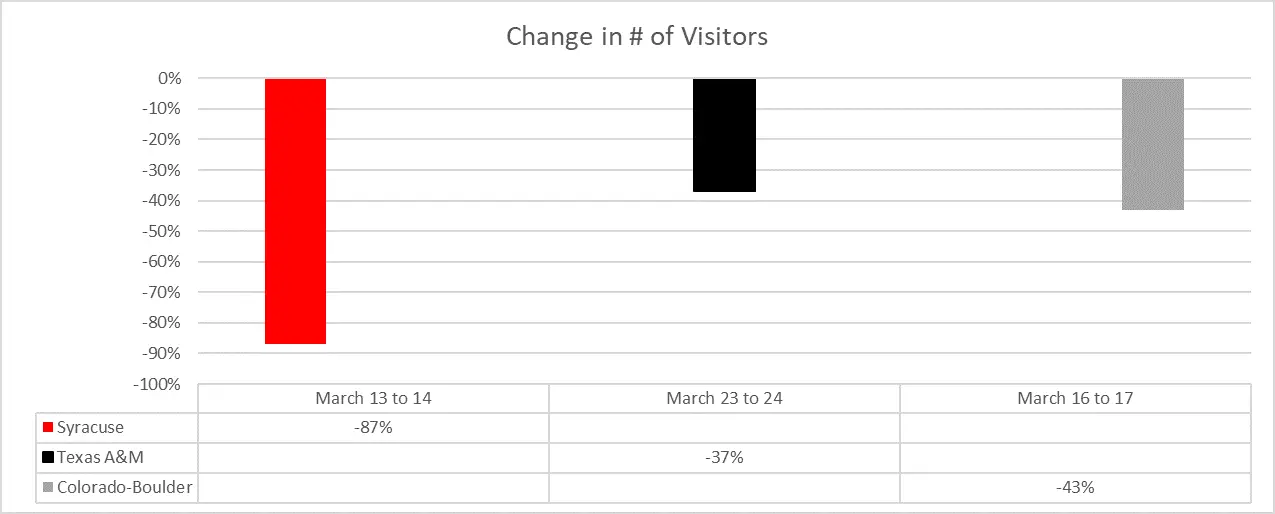

Syracuse announced on March 13 that students would begin online learning after Spring Break, the week of March 16. UC-Boulder had the same timeline with students gone the week of March 16. Texas A&M had students leave by March 23. We can see the immediate impact of those announcements on foot traffic at each building.

Given its real time nature, how could a real estate owner, operator or investor use this data? The decline in foot traffic shows a decrease in people in the building. Once tenants had left, a deep clean to help insulate the common areas of the building from the virus may be done . This would disrupt fewer tenants and help ease the anxiety of the remaining tenants. By decreasing the burden on the tenant base, the potential for renewals increases.

This data could be used to change how the building is operated and leased. Accessing real time data to adjust strategy and operations allows for better decision making and hopefully outperformance. Real time data may lead to cost-savings or just as important may prevent future spikes with operating problems averted.

Advan and Eigen10 Advisors are working to track and analyze the data in a broader and more long-term indexed fashion. For additional analysis of your property contact

Eddy Hribar at  or Jeff Havsy at

or Jeff Havsy at  .

.

1 NAA and NMHC have issued guidelines for apartment owners.