Walmart's recent announcements signal a robust commitment to expanding its footprint and enhancing customer experiences across North America. In Canada, the company is embarking on its most significant investment since entering the market nearly three decades ago. Concurrently, in the United States, Walmart is executing an ambitious growth strategy to strengthen its retail presence.

Walmart Canada's Landmark Investment and the U.S. expansion strategy

On January 30, 2025, Walmart Canada unveiled plans to invest approximately $4.51 billion (US dollars) to build new stores and upgrade its supply chain infrastructure. This investment includes the construction of dozens of new stores, starting with five new supercenters in Ontario and Alberta by 2027. Additionally, the company plans to modernize its distribution centers to improve both online and in-store customer experiences. This strategic move aims to make Walmart more relevant to a broader range of customers, from newcomers and urbanites to higher-income Canadians. The investment also involves selling Walmart Canada's fleet business to Canada Cartage, allowing the company to focus more on its core retail operations.

In the United States, Walmart has announced plans to build or convert more than 150 stores over the next five years. The company also intends to remodel 650 stores across 47 states and Puerto Rico within the next 12 months. These efforts are part of Walmart's strategy to modernize its facilities and enhance the shopping experience for customers.

Analyzing Store Visit Trends

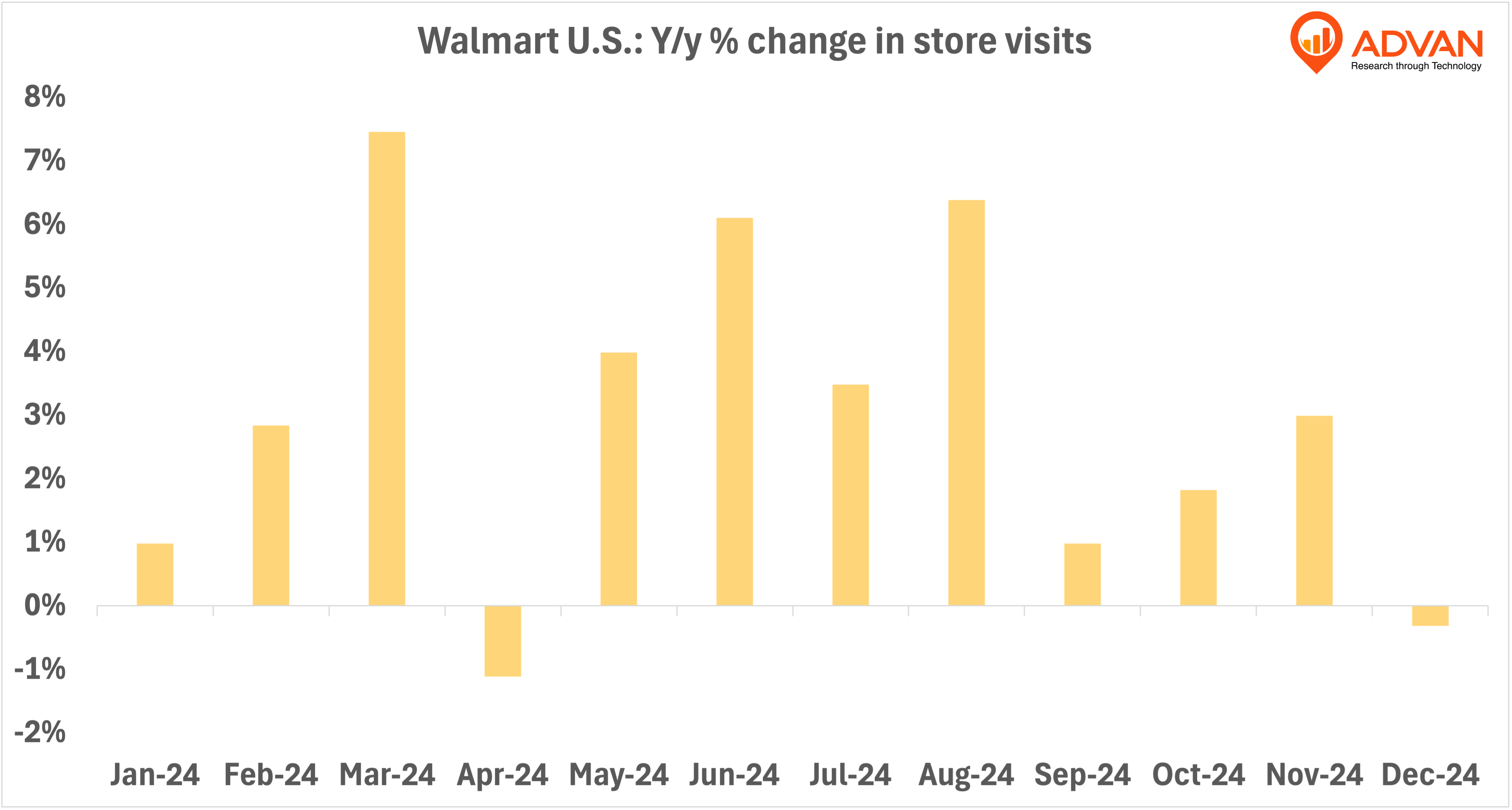

Let's see what Advan's location data reveal about Walmart's expansion plan.

In Canada, Walmart stores experienced strong year-over-year (YoY) growth in foot traffic throughout 2024. According to Advan’s data, visits surged during the summer, with July and August seeing the highest increases - over 20% - compared to the previous year. This spike reflects seasonal shopping habits, back-to-school spending, and increased discretionary shopping during the warmer months. However, traffic tapered off toward the end of the year, with November and December showing only modest-yet-growth, most likely due to a potential shift toward e-commerce or just a pullback in consumer spending.

In the U.S., Advan’s data shows a more stable-yet-subdued pattern in 2024. While most months recorded modest single-digit growth, April stood out with a slight decline in visits. This dip could indicate economic pressures affecting consumer behavior, such as inflation or shifting spending priorities. Despite this, Walmart’s ability to maintain steady foot traffic signals the continued relevance of its physical stores, even as online shopping expands.

Walmart’s investment strategy seems well-aligned with Advan’s visit trends. In Canada, where store visits saw strong seasonal spikes, the company’s expansion could further capture demand by enhancing in-store experiences and convenience. In the U.S., where store visits remain steady but less dynamic, Walmart’s focus on store remodels and modernized layouts may help sustain and grow its customer base even in a market with higher competition.

The substantial investments in both Canada and the United States emphasize the retail giant's dedication to enhancing retail infrastructure and customer experience. The positive trends in store visits, particularly in Canada, reflect the potential success of these initiatives. As Walmart continues to execute its expansion strategies, it will be essential to monitor how these developments influence customer engagement and overall market presence in the coming years.

By leveraging insights from Advan’s data, any brand can refine its expansion strategy, ensuring that new investments are optimized to meet evolving consumer behaviors in both markets (U.S. and CA) as well as internationally.