Join our exclusive community and gain access to Advan's latest market insights across industries, including

real estate, retail, CPG, entertainment, travel, healthcare, industrials and more.

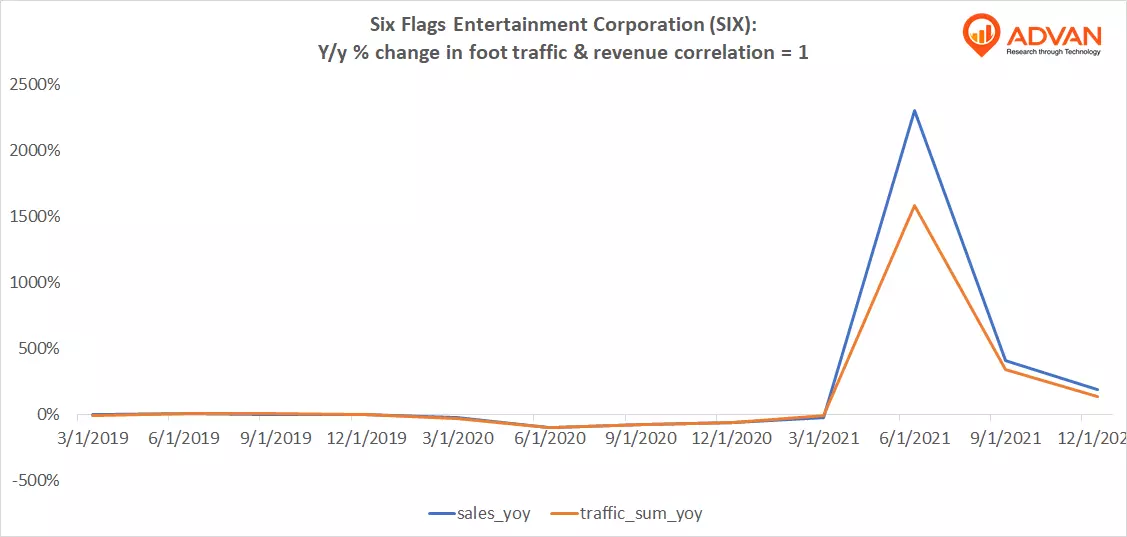

Notable Hit: (SIX:NYSE) On Thursday February 24, 2022 Six Flags Entertainment Corporation (SIX) posted better-than-expected revenues of $316.81mm surpassing the consensus estimate of $268.22mm or by +18.1% and in the same direction as Advan's forecasted sales. The revenue was up 192% YoY and +21%...

The hardest-hit New York City is bouncing back once again as Omicron cases continue to rapidly fall at the same speed they increased in mid-December and New Yorkers look forward to enjoy the city as it was before the pandemic. ADVAN’s foot traffic data shows an uptick in foot traffic mobility...

Notable Hit: (CHH:NYSE) On Thursday February 17, 2022 Choice Hotels International, Inc. (CHH) posted better-than-expected revenues of $284.6mm surpassing the consensus estimate of $274.86mm or by +3.5% and in the same direction as Advan's forecasted sales. The revenue was up 47% YoY and up 6% Yo2Y...

Notable Hit: (MGM:NYSE) On Wednesday February 9, 2022 MGM Resorts International (MGM) posted better-than-expected revenues of $3.057bn surpassing the consensus estimate of $2.79bn or by +9.6% and in the same direction as Advan's forecasted sales. The revenue was up 105% YoY - Advan's foot traffic...

Notable Hit: (PENN:NASDAQ) On Thursday February 3, 2022 Penn National Gaming, Inc. (PENN) posted better-than-expected revenues of $1.57bn surpassing the consensus estimate of $1.49bn or by +5.4% and in the same direction as Advan's forecasted sales. The revenue was up 53% YoY - Advan's foot traffic...

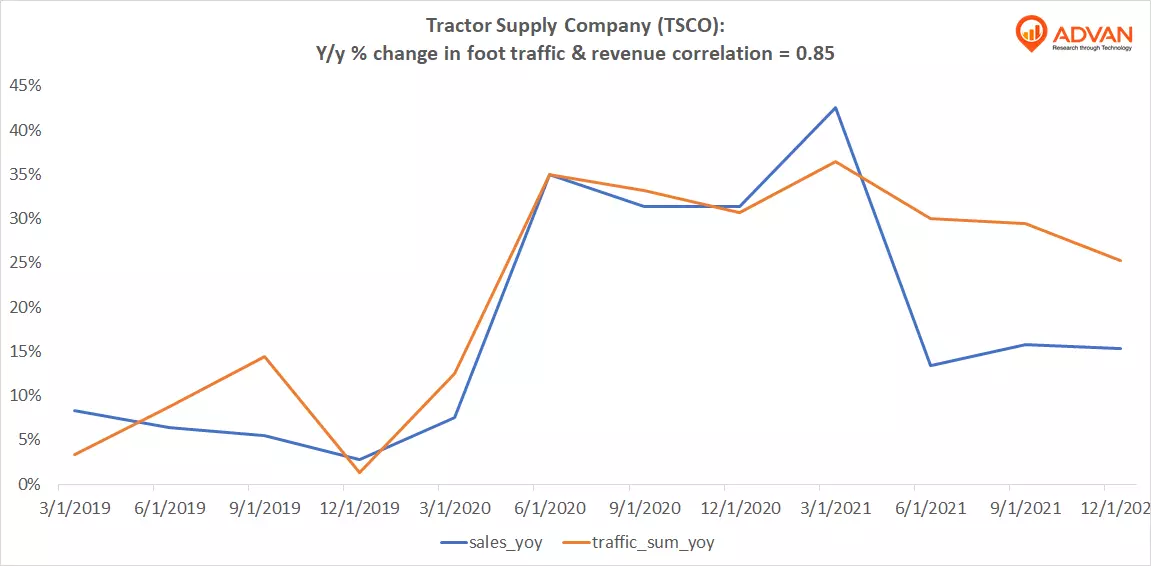

Notable Hit: (TSCO:NASDAQ) On Thursday January 27, 2022 Tractor Supply Company (TSCO) posted better-than-expected revenues of $3.32bn surpassing the consensus estimate of $3.21bn or by +3.4% and in the same direction as Advan's forecasted sales. The revenue was up 15% YoY - Advan's foot traffic...

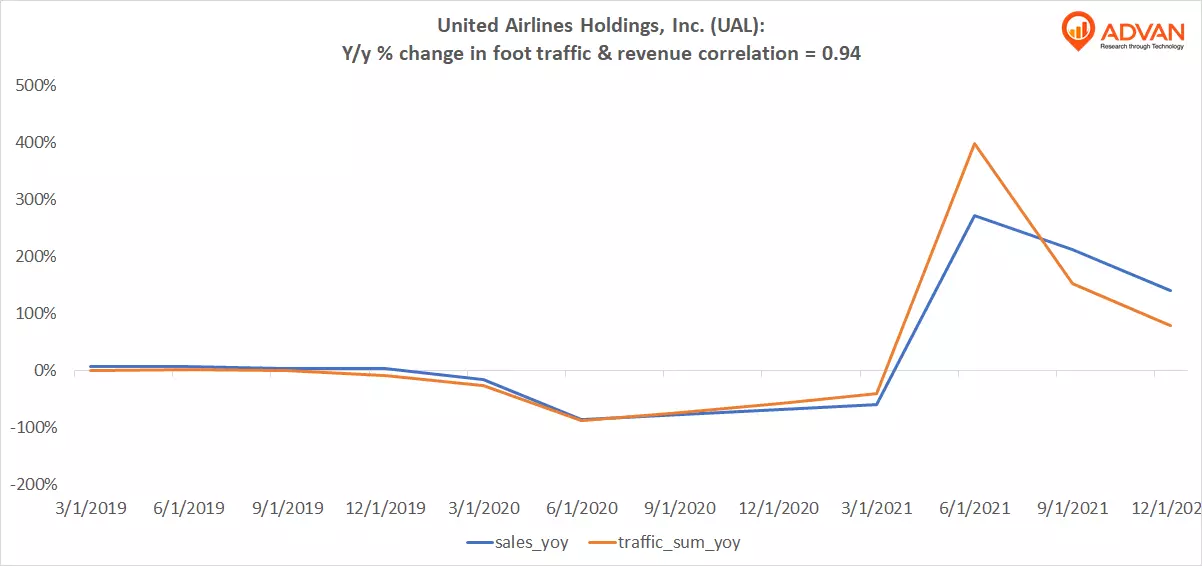

Notable Hit 1: (UAL:NASDAQ) On Thursday January 21, 2022 United Airlines Holdings, Inc. (UAL) posted better-than-expected revenues of $8.192bn surpassing the consensus estimate of $7.93bn or by +3.3% and in the same direction as Advan's forecasted sales. The revenue was up 140% YoY - Advan's foot...

Notable Hit: (DAL:NYSE) On Thursday January 13, 2022 Delta Air Lines, Inc. (DAL) posted better-than-expected revenues of $9.47bn surpassing the consensus estimate of $8.77bn or by +7.98% and in the same direction as Advan's forecasted sales. The revenue was up 138% YoY - Advan's foot traffic data...