Join our exclusive community and gain access to Advan's latest market insights across industries, including

real estate, retail, CPG, entertainment, travel, healthcare, industrials and more.

Notable Hit: (BBBY:NASDAQ) On Thursday January 6, 2022 Bed Bath & Beyond Inc. (BBBY) posted worse-than-expected revenues of $1.88bn missing the consensus estimate of $1.97bn or by -4.57% and in the same direction as Advan's forecasted sales. The revenue was down 28% YoY - Advan's foot traffic data...

Notable Hit: (DRI:NYSE) On Friday December 17, 2021 Darden Restaurants, Inc. (DRI) posted better-than-expected revenues of $2.27n beating the consensus estimate of $2.23bn or by 1.8% and in the same direction as Advan's forecasted sales. The revenue was up 37% YoY - Advan's foot traffic data...

Notable Hit 1: (THO:NYSE) On Wednesday December 8, 2021 Thor Industries, Inc. (THO) posted better-than-expected revenues of $3.96bn beating the consensus estimate of $3.48bn or by 13.8% and in the same direction as Advan's forecasted sales. The revenue was up 56% YoY - Advan's foot traffic data...

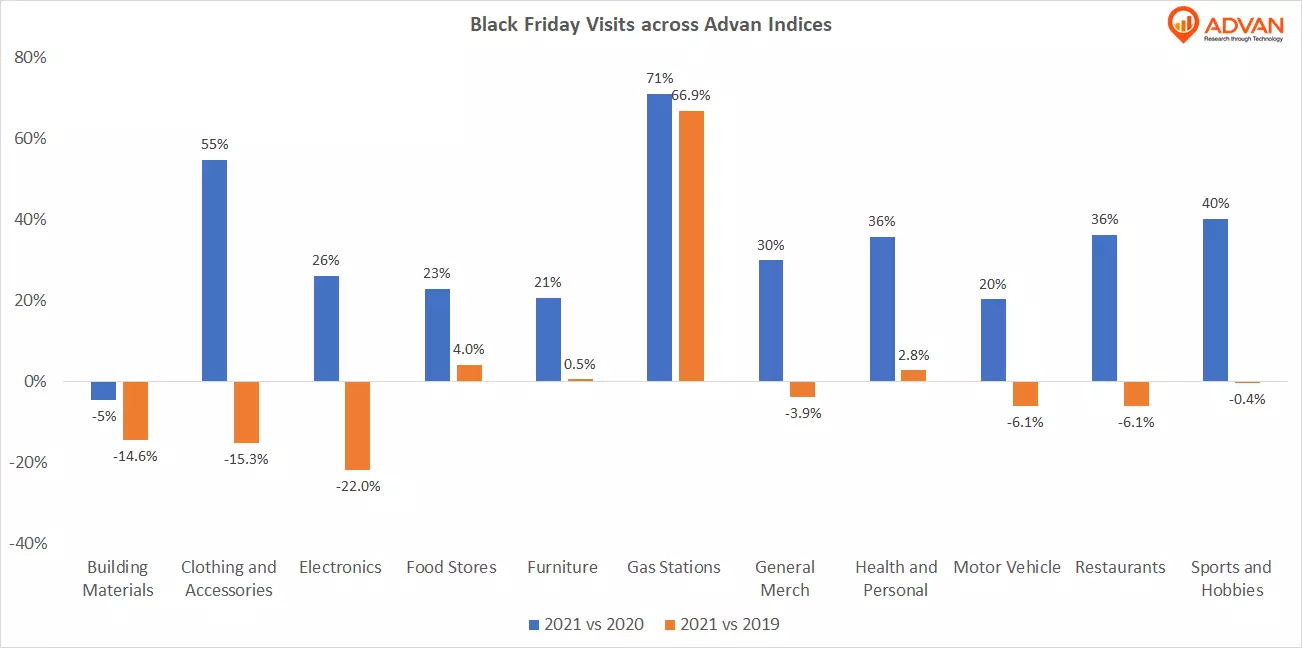

Traffic on Black Friday after Thanksgiving was materially higher across Advan Indices compared with last year’s levels. But visits are still down compared to 2019 records for most of the indices. Clothing and Accessories index saw an increase of 55% yoy but down 15.3% Yo2Y while Furniture and Food...

Notable Hit 1: (FIVE:NASDAQ) On Wednesday December 1, 2021 Five Below, Inc. (FIVE) posted better-than-expected revenues of $607.65mm beating the consensus estimate of $561.32mm or by 8.2% and in the same direction as Advan's forecasted sales. The revenue was up 27.5% YoY - Advan's foot traffic data...

The lower tranches of MSBAM 2013-C10 have been in trouble since the beginning of the pandemic. Fitch details their latest downgrade in their last update at the end of September.

In particular, the downgrade is due to the troubles at Westfield Citrus Park, which is in a friendly foreclosure;...

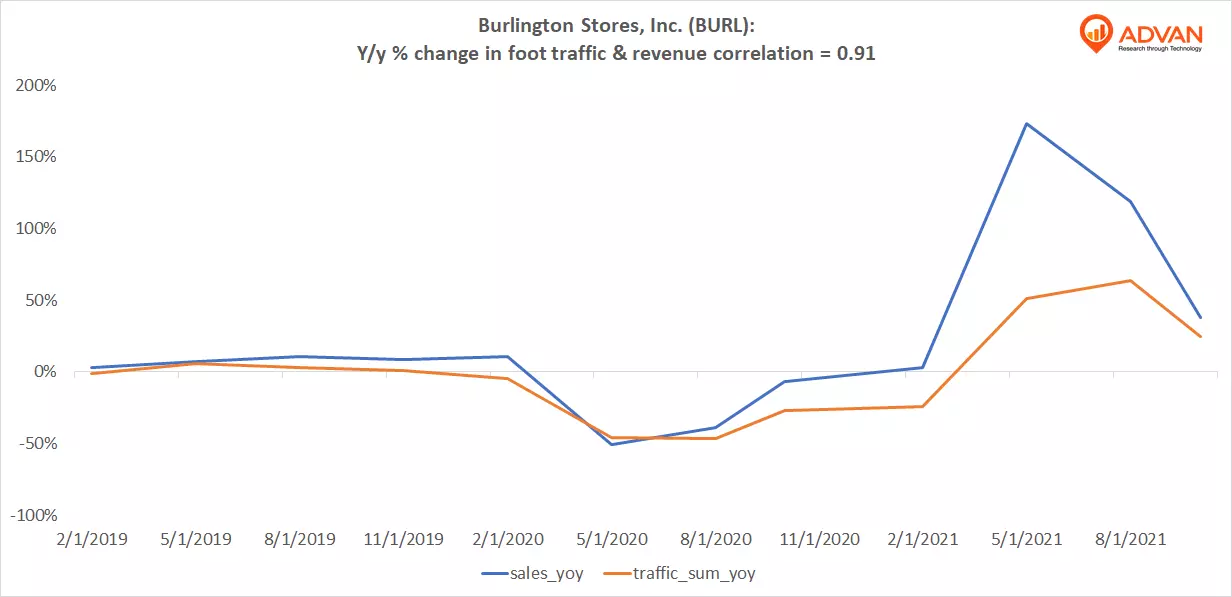

Notable Hit 1: (BURL:NYSE) On Tuesday November 23 , 2021 Burlington Stores, Inc. (BURL) posted better-than-expected revenues of $2.3bn beating the consensus estimate of $2.22bn or by 3.44% and in the same direction as Advan's forecasted sales. The revenue was up 38.19% YoY - Advan's foot traffic...

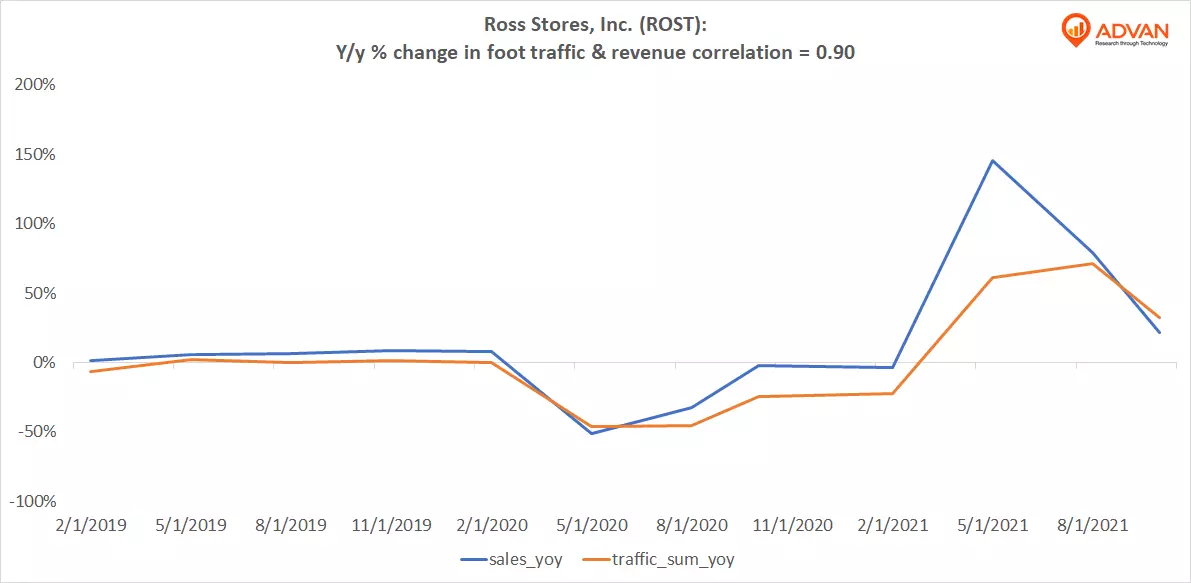

Notable Hit 1: (ROST:NASDAQ) On Thursday November 19 , 2021 Ross Stores, Inc. (ROST) posted better-than-expected revenues of $4.57bn beating the consensus estimate of $4.31bn or by 6% and in the same direction as Advan's forecasted sales. The revenue was up 22% YoY - Advan's foot traffic data...