Join our exclusive community and gain access to Advan's latest market insights across industries, including

real estate, retail, CPG, entertainment, travel, healthcare, industrials and more.

Snack & Beverages Under Pressure As Consumer Cuts Visits Into The C-Store

Given the deterioration in traffic and conversion at C&G stores since October, as shown in the chart above, it wasn’t a surprise to see weak results and guidance by PepsiCo this week. CEO Laguarta in the press release...

Walmart's recent announcements signal a robust commitment to expanding its footprint and enhancing customer experiences across North America. In Canada, the company is embarking on its most significant investment since entering the market nearly three decades ago. Concurrently, in the United...

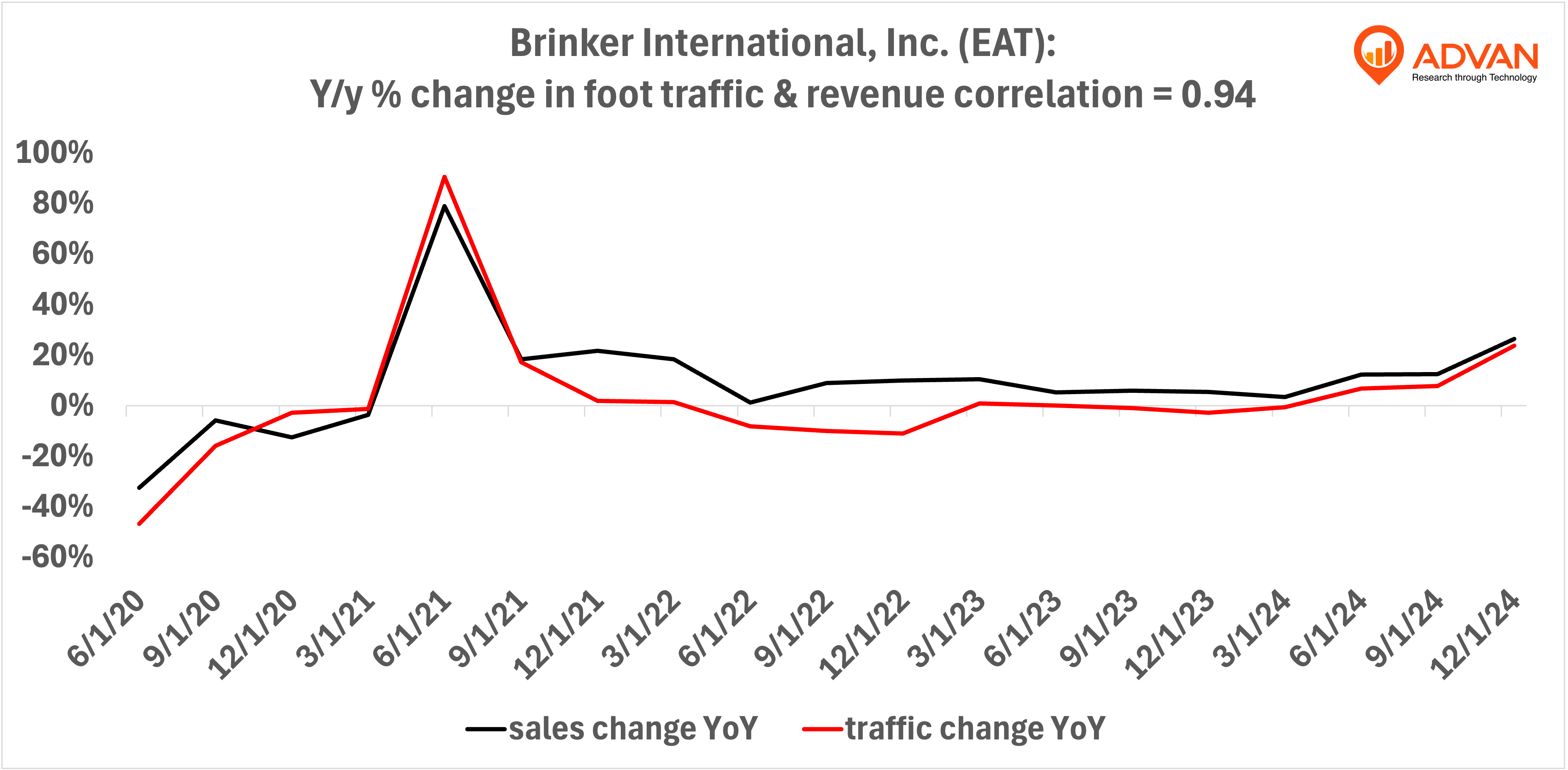

Notable Hit 1: (EAT:NYSE) On Wednesday January 29, 2025 Brinker International, Inc. (EAT) posted revenues of $1.36 bn surpassing the analysts estimates by 14% and in the same direction as Advan's forecasted sales. Advan's data showed a 23.8% increase YoY in foot traffic to its restaurant chains in...

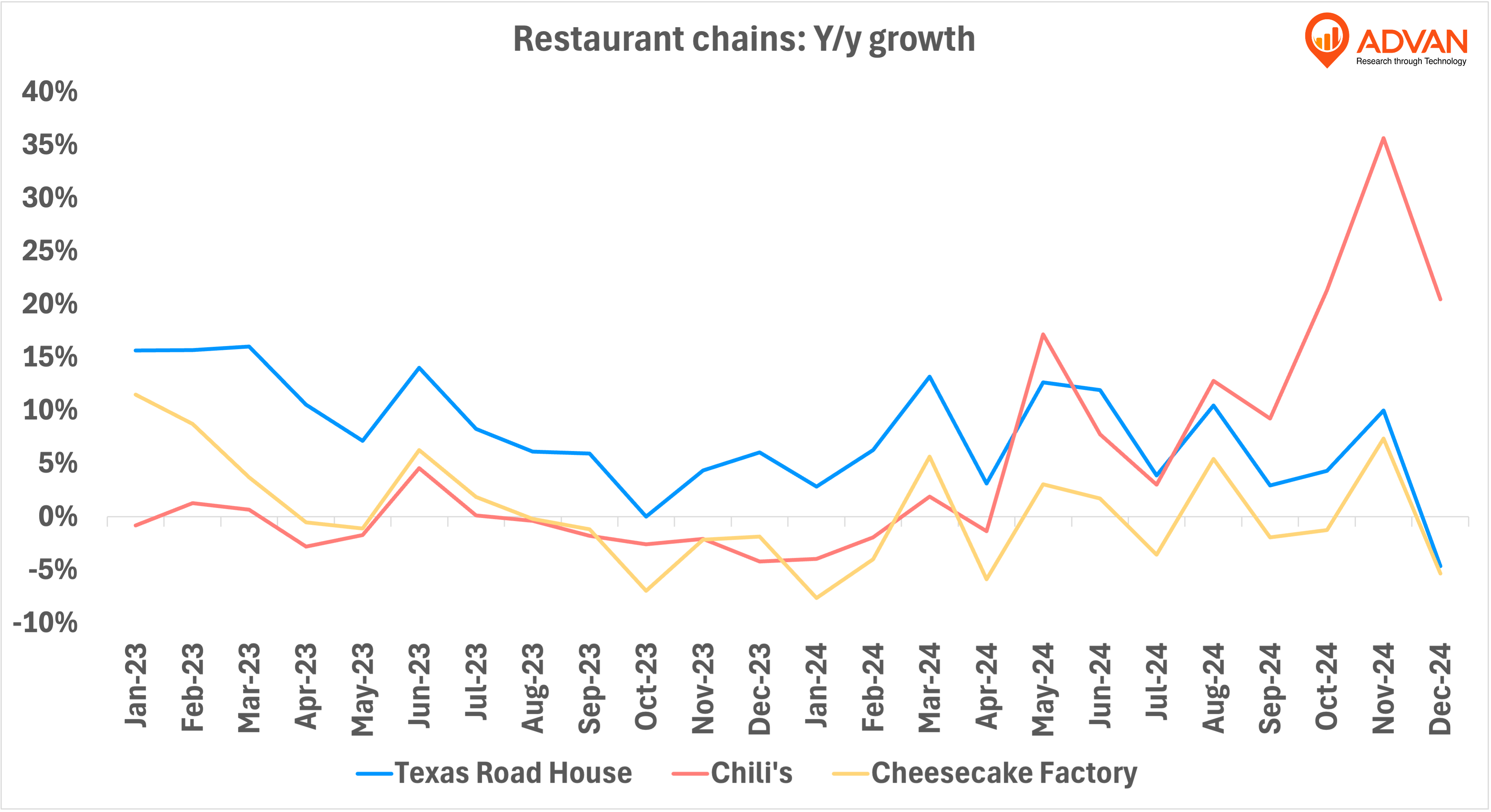

The casual dining scene in the U.S. has been a rollercoaster over the past two years, with some brands struggling to keep pace while others have found ways to thrive. Chili’s, Texas Roadhouse, and The Cheesecake Factory have all experienced their ups and downs, but Chili’s recent turnaround stands...

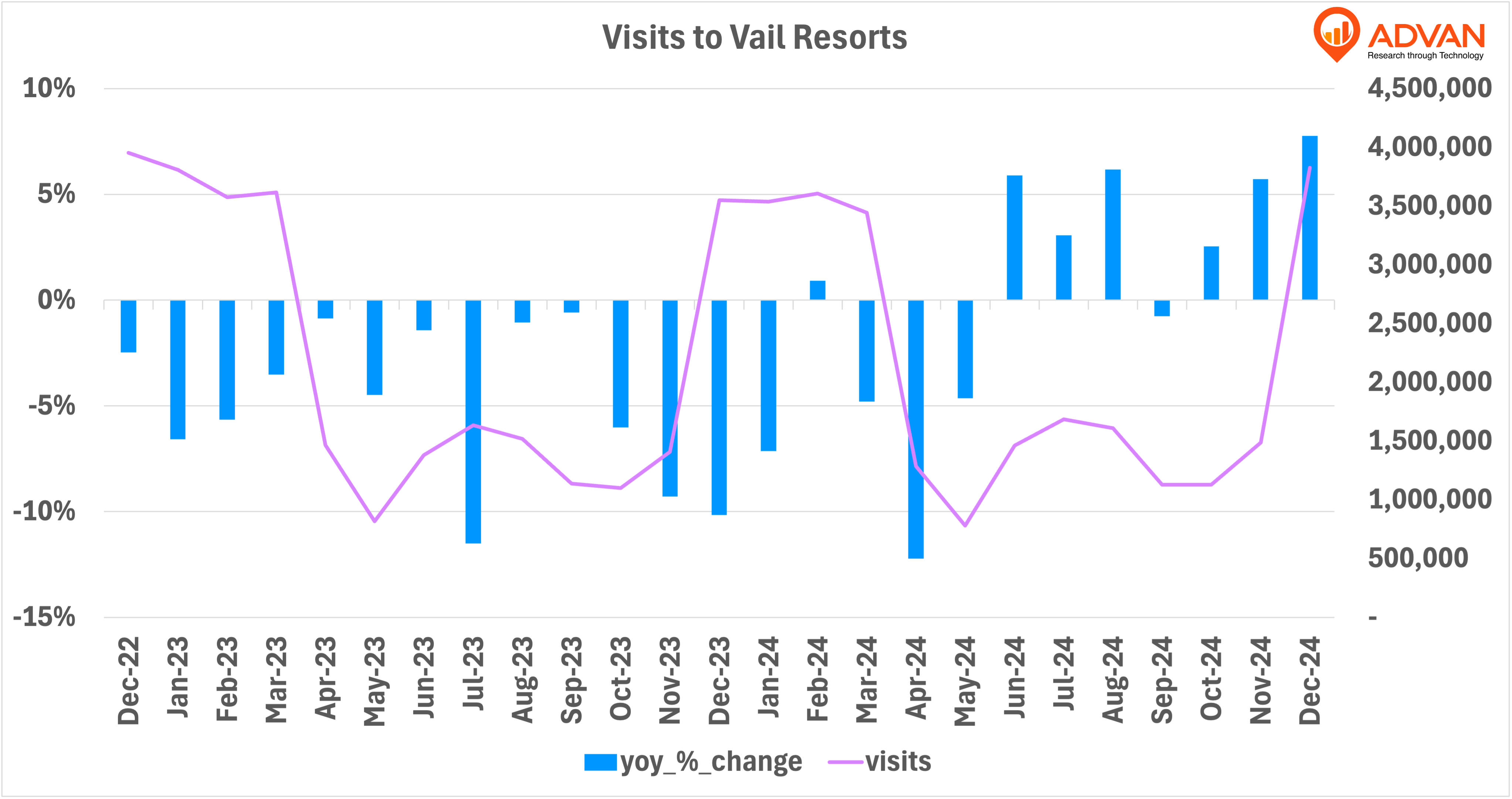

Vail Resorts, a leader in the ski industry, has long been defined by its aggressive expansion strategy and the introduction of the Epic Pass, which revolutionized how skiers access multiple destinations. However, recent challenges, including labor disputes, operational issues, and competition from...

Notable Hit 1: (UAL:NASDAQ) On Tuesday January 21, 2025 United Airlines Holdings, Inc. (UAL) posted revenues of $14.7 bn surpassing the analysts estimates by 3% and in the same direction as Advan's forecasted sales. Advan's data showed a 6.7% increase YoY in foot traffic to terminals at hubs...

Notable Hit 1: (DAL:NYSE) On Friday January 10, 2025 Delta Air Lines, Inc. (DAL) posted revenues of $15.56 bn surpassing the analysts estimates by 10% and in the same direction as Advan's forecasted sales. Advan's data showed a 3.3% increase YoY in foot traffic to the terminals at hubs operated by...

Notable Hit 1: (DRI:NYSE) On Thursday December 19, 2024 Darden Restaurants, Inc. (DRI) posted revenues of $2.89 bn surpassing the analysts estimates by 1% and in the same direction as Advan's forecasted sales. Advan's data showed a 2.3% increase YoY in foot traffic to its restaurants, including...