Join our exclusive community and gain access to Advan's latest market insights across industries, including

real estate, retail, CPG, entertainment, travel, healthcare, industrials and more.

By Thomas Paulson, Head of Market Insights

Yes, the stock market and economy are in a tempest, and investors have been de-risking their portfolios and cutting exposure to cyclical companies and those that have too much debt; that change in preferences favors consumer staples and utility stocks....

By Thomas Paulson, Head of Market Insights

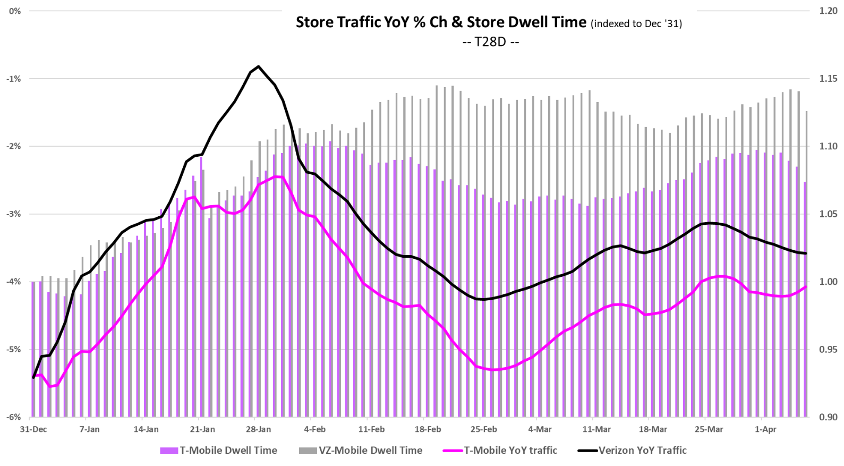

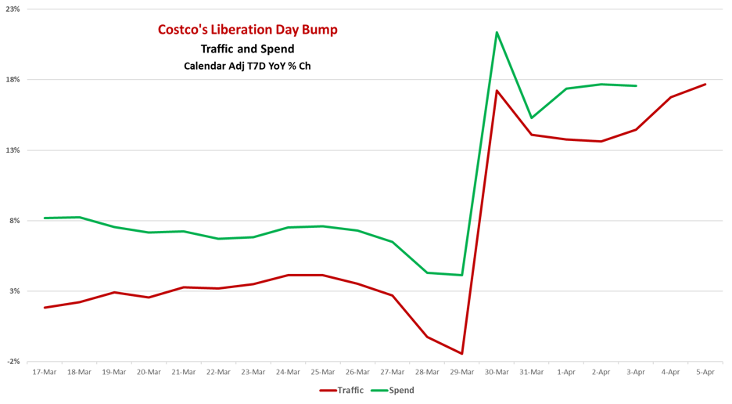

Last Friday, we delivered a presentation to Morgan Stanley’s institutional clients. Our conclusion of the work was that consumer spending had picked up in March following a slow start to the year. However, given Wednesday’s news, what happened in March...

By Thomas Paulson, Head of Market Insights

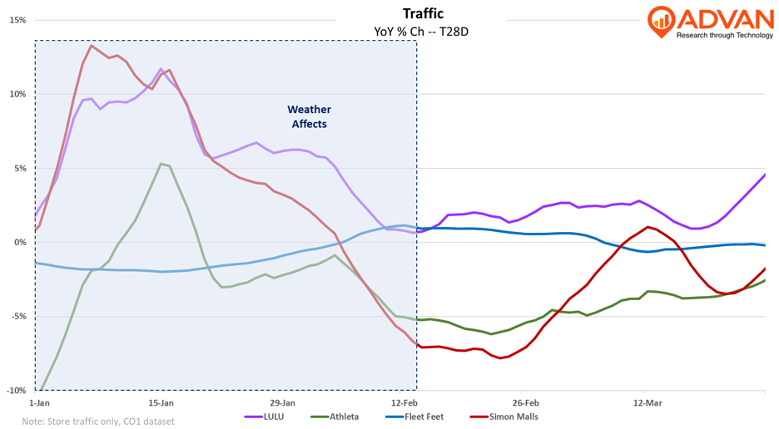

Lululemon’s quarterly results in the Americas segment (Canada and the United States) were flat on a comparable basis; the segment’s revenue increased +2% (ex-unusuals) reflecting the contribution of more locations. Advan estimates that traffic per...

By Thomas Paulson, Head of Market Insights

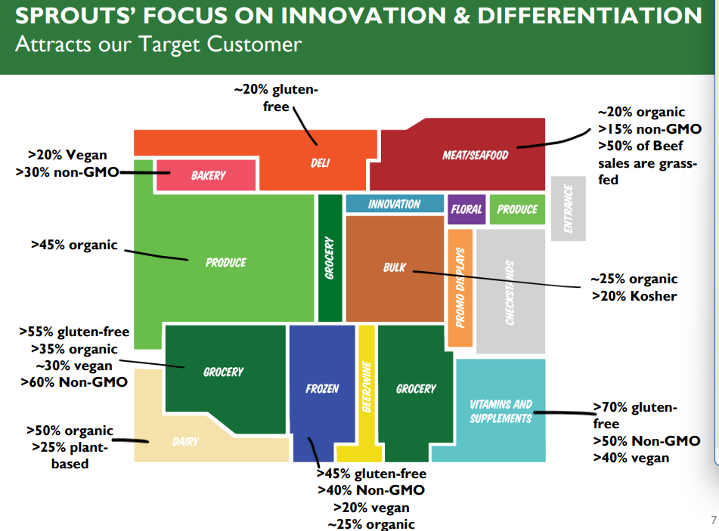

We’ve recently analyzed Sprouts Farmers Market’s strong 2024 performance and highlighted its success of driving capturing market share and avoiding the grocery industry’s woes. That success stems from merchandise differentiation (see the figure below)....

By Thomas Paulson, Head of Market Insights

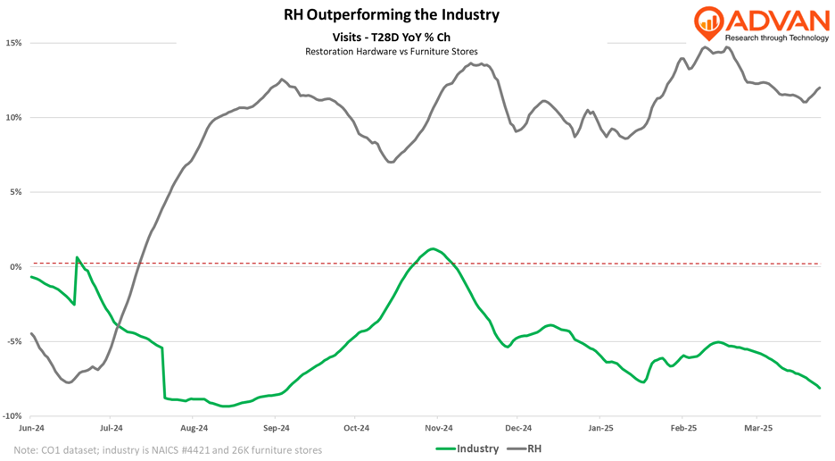

RH reports quarterly results next week and we expect strong revenue growth of +12% ($829M). RH has seen its revenue improve each quarter this past fiscal year, after declining -16% last year (meaning 2023). Visits are up roughly 10% for the quarter which...

By Thomas Paulson, Head of Market Insights

Dollar Tree reported an improvement in its comp-store sales trend due to an improvement in its discretionary business (as did Dollar General, Walmart, and Target). The discretionary comp increased by +0.4%, the first positive number of the year; moreover,...

By Thomas Paulson, Head of Market Insights

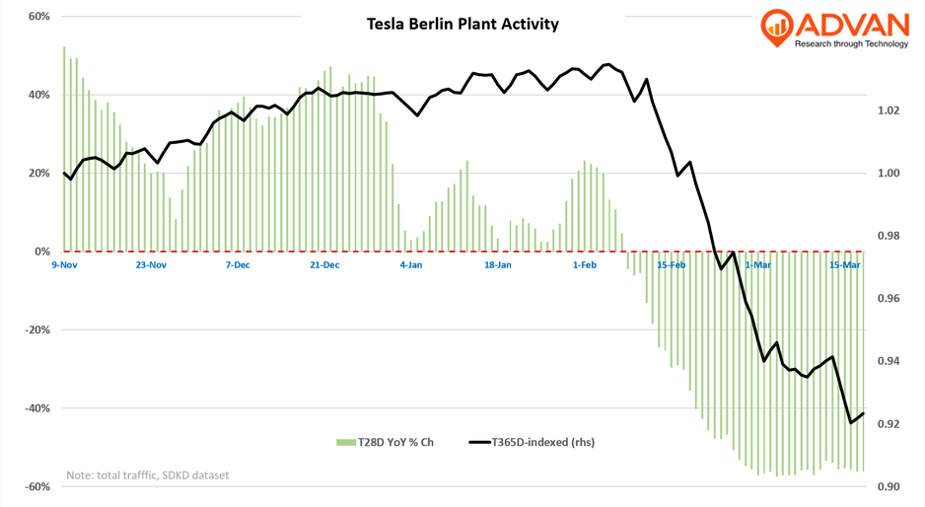

Reports of brand rejection of Tesla are shocking, “unprecedented” is also a relevant characterization. Germany was its largest market in Europe including a poll of 100,000 with 94,000 saying they wouldn’t buy the brand. This follows an estimated drop in...

By Thomas Paulson, Head of Market Insights

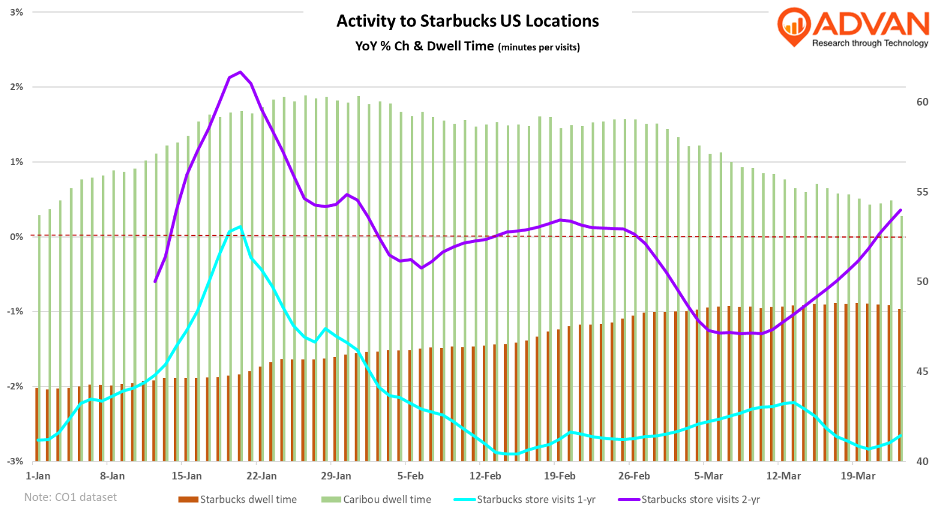

Lately, we’ve read some commentary that CEO Brian Niccol’s plan to turn Starbucks around has failed to turn the business, because the brand has lost some wallet share. However, Niccol didn’t plan an immediate turn; he has planned for a long-term sustained...