Join our exclusive community and gain access to Advan's latest market insights across industries, including

real estate, retail, CPG, entertainment, travel, healthcare, industrials and more.

By Thomas Paulson, Head of Market Insights

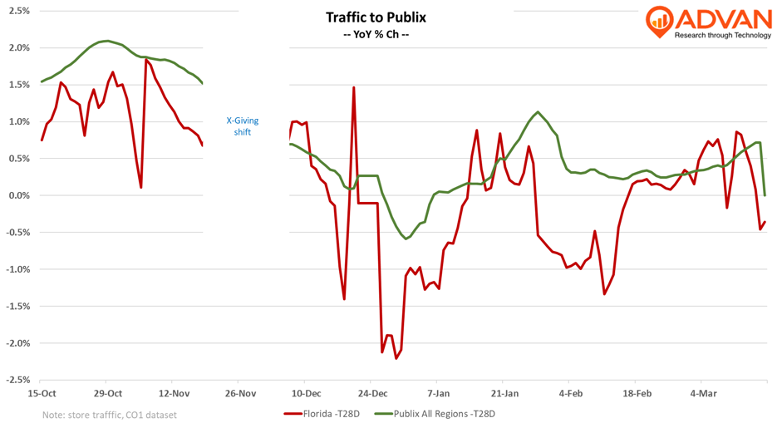

In the context of a market that grew by +3.2% in value and +2.1% in volume, Advan took a look at Publix’s and General Mills’ Q4 results, along with two smaller regional grocers in California – Smart & Final and Stater Bros, brands that we shop and that...

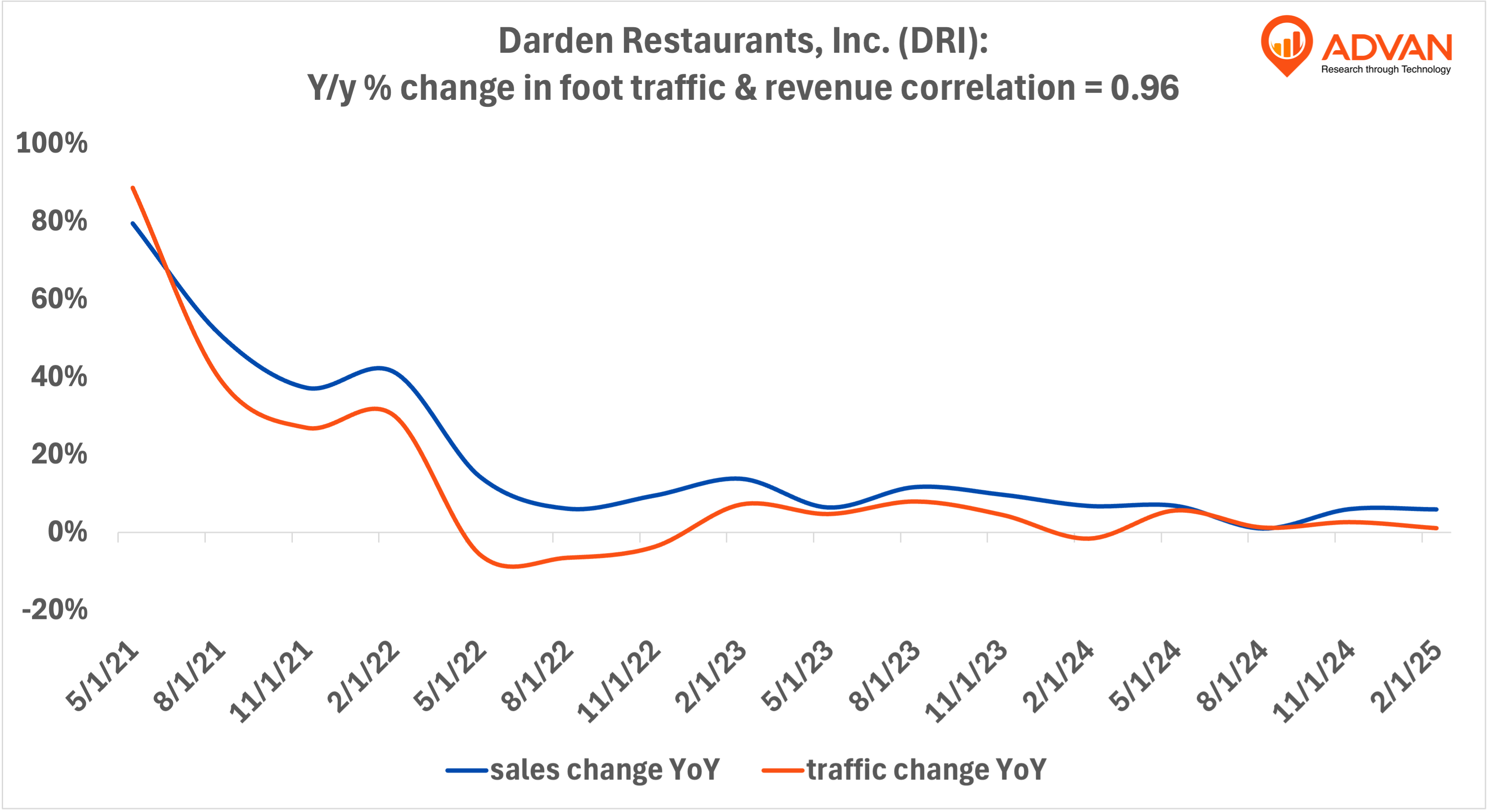

Notable Hit 1: On Thursday March 20, 2025 Darden Restaurants, Inc. (DRI) posted revenues of $3.15BN missing the analysts estimates by 1.5% and in the same direction of Advan's implied sales. Advan's data showed a 1% increase YoY in overall foot traffic across all Darden's chains, including Oliver...

By Thomas Paulson, Head of Market Insights

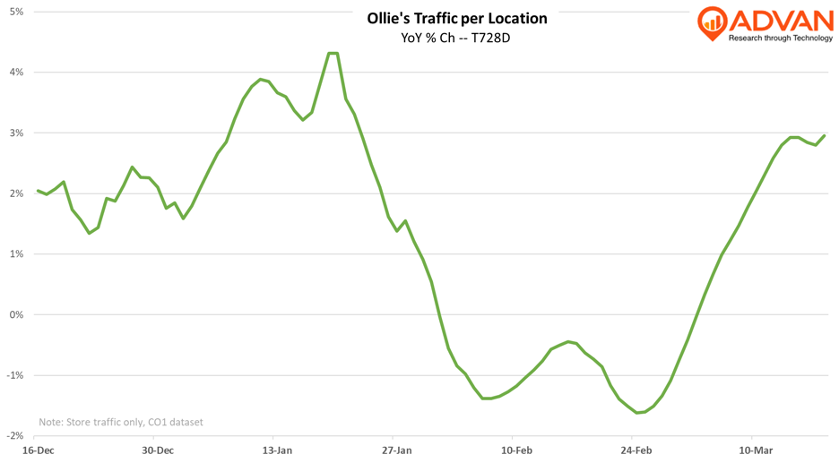

Ollie’s Bargain Outlet Holdings reported solid FQ4 results with adjusted sales growth of +9% to $667M (just shy of Advan’s estimate of $672M). Growth was driven by a +2.8% comp-sales increase and 47 (+9%) more stores over the past year, including...

By Thomas Paulson, Head of Market Insights

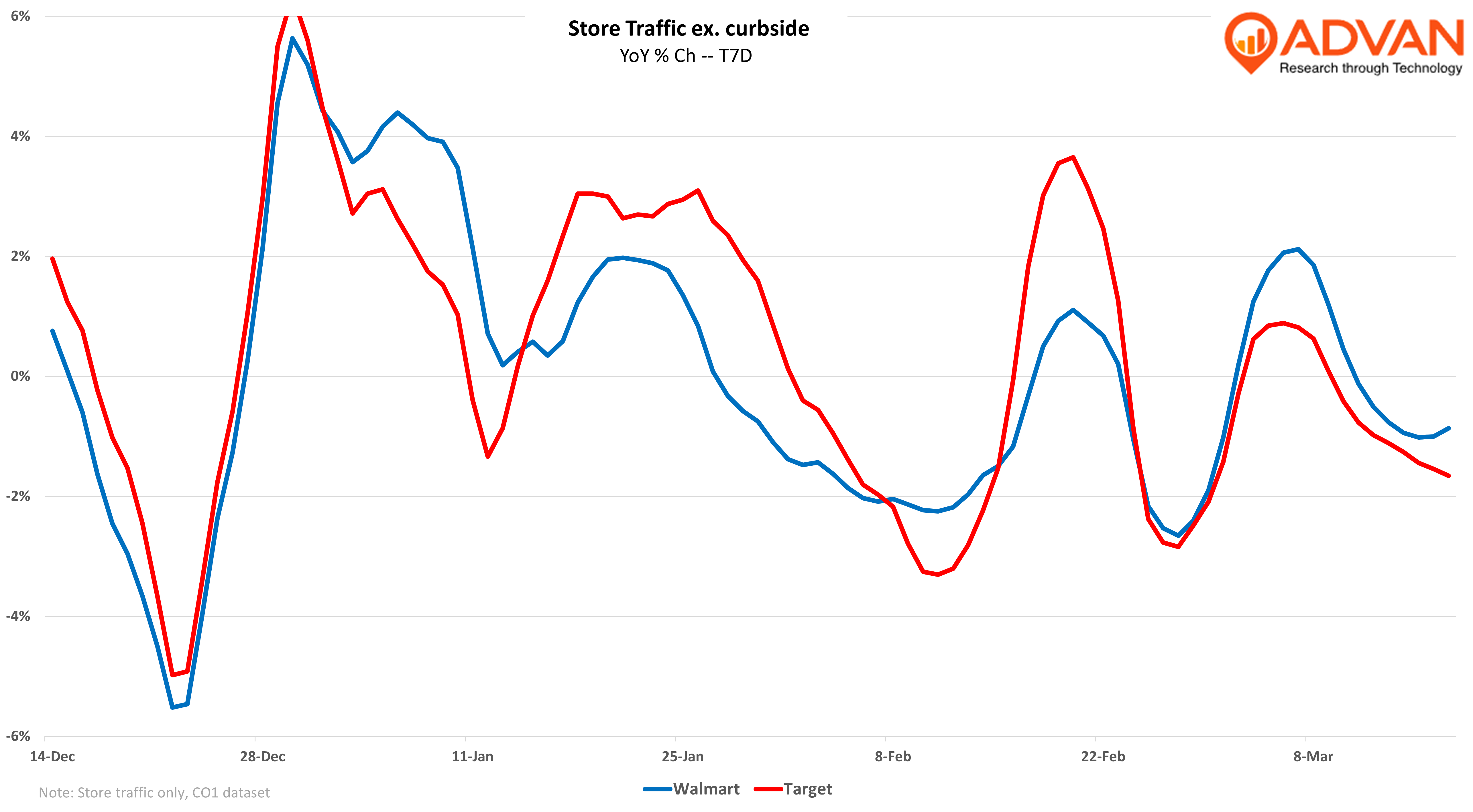

Over the weekend, again numerous press and blog reports declared Target’s store traffic to be down due to boycotts and upset feelings over Target’s messaging around DEI. However, those reports cite a traffic decline YoY against a week last year that...

By Thomas Paulson, Head of Market Insights

Ulta Beauty reported a comp-sales increase for Q4 of +1.5%, driven by a +3.0% increase in average ticket and a -1.4% decrease in comp-transactions. Removing the lift from ecommerce sales, store comp-sales increased modestly, suggesting a slight decline in...

By Thomas Paulson, Head of Market Insights

Dollar General reported $10.2B revenue for Q4, up +5.0% YoY, and above our +3.9% estimate* (120bps Moe, 97% correlation). Comp-sales increased +1.2% driven by consumables (+2.7%). The non-consumables comp was roughly flat, the best result since early 202...

By Thomas Paulson, Head of Market Insights

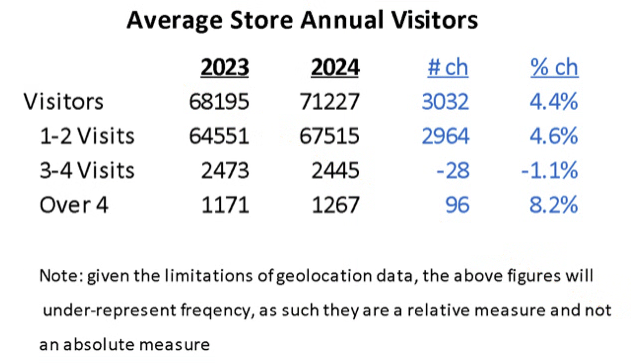

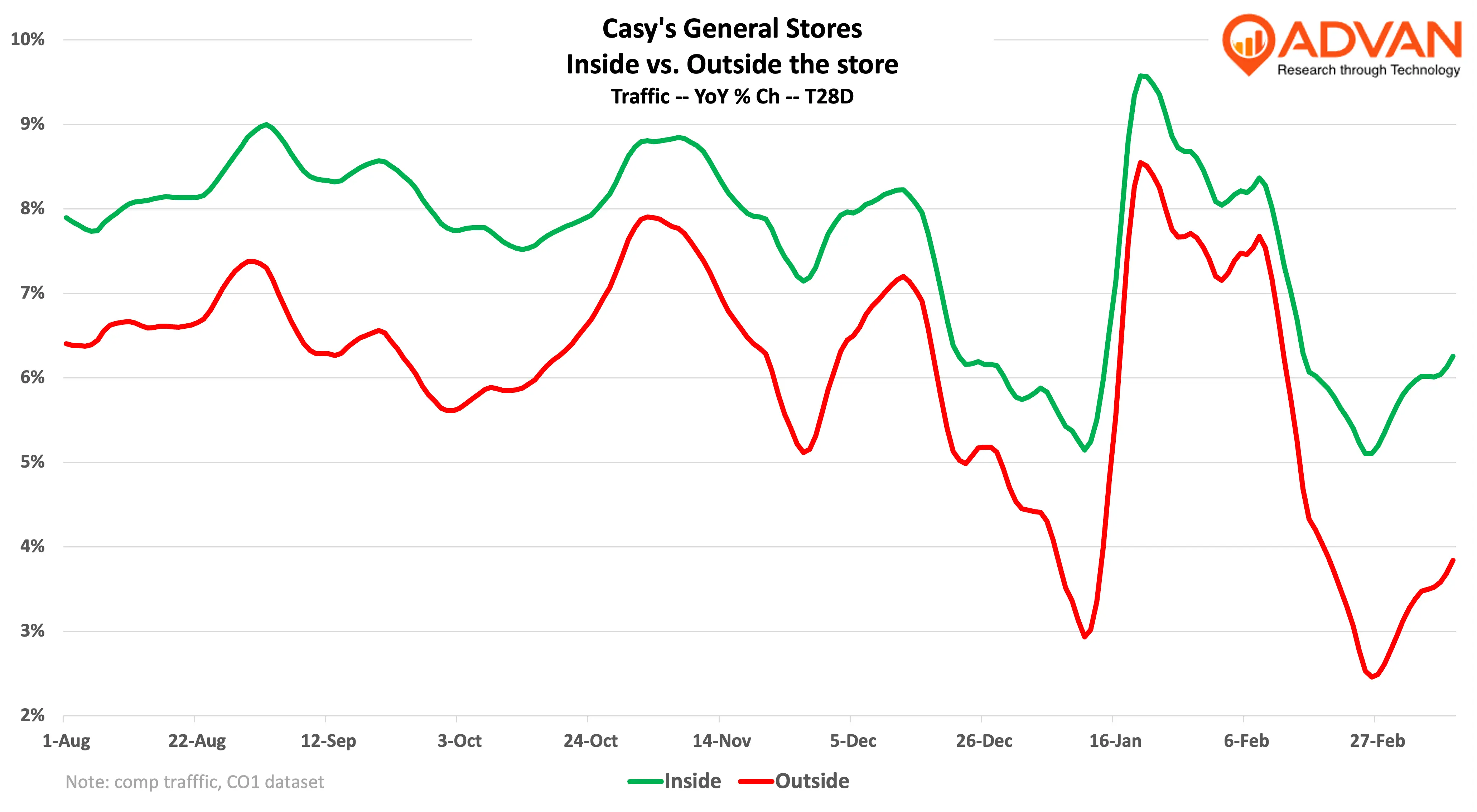

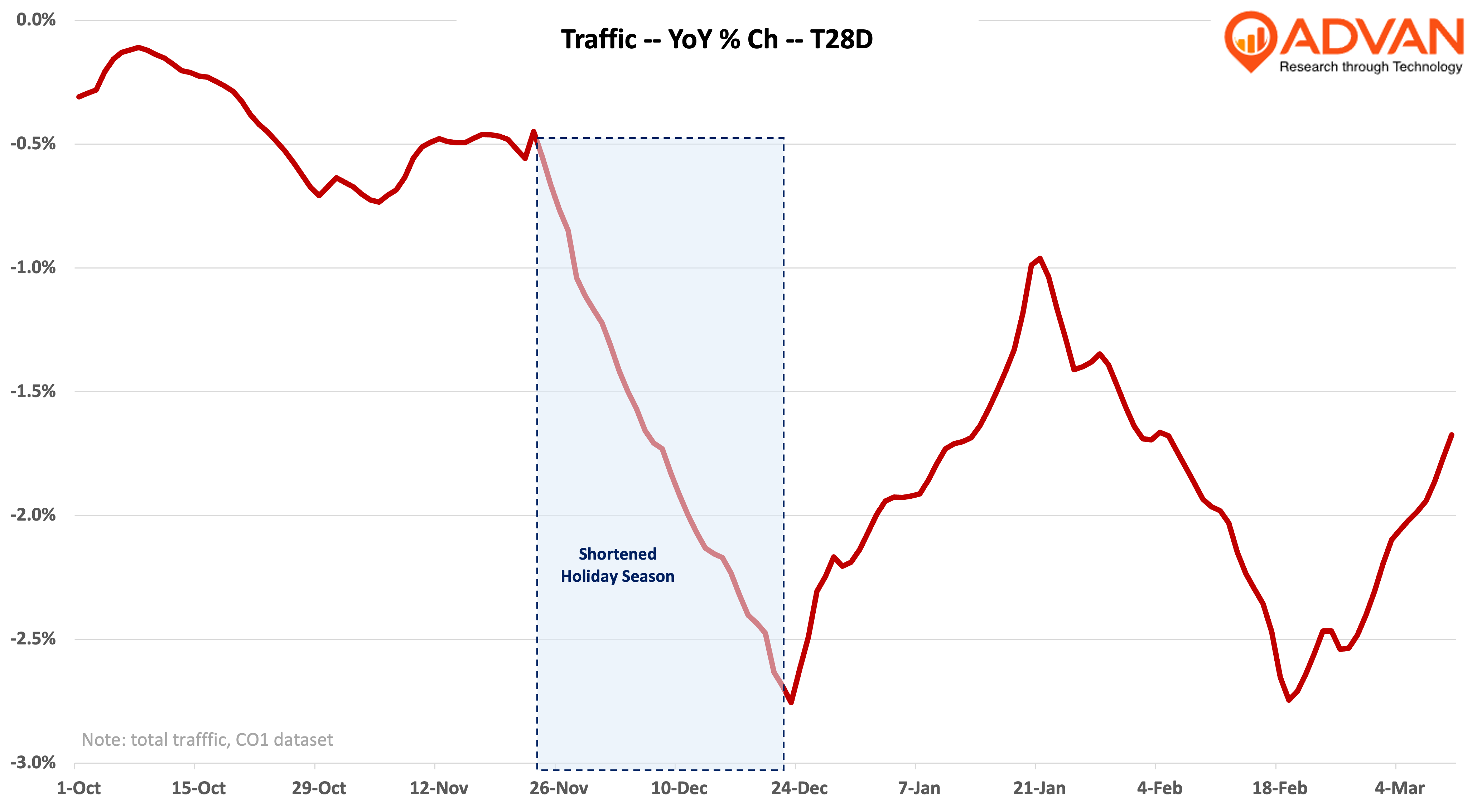

Casey’s General Stores, Inc reported strong quarterly results for its “inside” business with comp-sales on prepared food & dispensed beverages increasing 4.7% and grocery & general merchandise increasing 3.3%. As a reminder, the gas & convenience channel...

By Thomas Paulson, Head of Market Insights

Kohl’s: Quarterly sales were “less bad” at a decline (-9.4%) than our preview (we said -14%). In our preview, we also forecasted that incoming CEO Ashley Buchanan would set a very low bar on forward expectations, he did. Revenue for 2025 was guided for a...